Chiropractic Billing Network Effect

Looking at the landscape of the chiropractic practice management, we see a playing field tipped to benefit the payers and hurt physicians. By increasing billing costs, underpaying claims and conducting a growing number of post-claim audits, insurance companies strive to keep profits high while depressing those of individual practice owners. To counteract these methods, healthcare providers need to streamline their business practices and take advantage of billing networks. The relationship between payers and providers is adversarial, but billing networks offer solid strategies that allow providers to get back into–and win–the game. The “network effect” allows a large number of disparate practice owners to capitalize upon their strength in numbers. It works like this… when one practice has an underpaid claim for a certain insurance company Genesis creates a rule to fix it moving forward for every other practice that bills that same insurance company. Repeat for each problem with insurance companies paying claims and over time you build an enormous set of rules to get claims paid in full and on-time. That’s the network effect.

Billing Stimulus and Network Effect for Practice Profitability – Dr. Troy Dreiling

The billing stimulus and chiropractic network effect increases your Practice Profitability. https://youtu.be/C7BKPJYqdew Insurance company claims are very important, so watch Dr. Troy Dreiling explain how great Genesis Chiropractic Software has been for his thriving practice. How do you expedite your insurance collections? How to qualify for $45,000 in Genesis’s Referral Stimulus? We share the same Billing Central Nervous System (CNS). Insurance companies profit on the float. The longer they keep our money – the more profit they make. Shared CNS expedites payments to the members of Genesis’s network. The larger the shared CNS becomes, the faster we all get paid! Refer your friends to expedite your insurance collections.

Level the Playing Field with Insurance Companies!

Dr. Chris Zaino explains how the Chiropractic Billing Network in Genesis will help your practice level the playing field with insurance companies. Vericle®, the technology behind Genesis’s service, has over 2 Million Rules (and growing) that are used to validate claims prior to submission.

Dr. Troy Dreiling speaks about Chiropractic Billing Software

Dr. Troy Dreiling speaks about Chiropractic Documentation SOAP notes that have speed and compliance built into the Genesis Chiropractic Software. https://youtu.be/LO-bZSrd6fs

Manage Your Day to Day Chiropractic Office Operations with Billing Precision

Make Sure Every Day at the Office is as Profitable as it Can Be As a chiropractor with a busy office you may find that you’re working very hard to make very little money. You’ve certainly got patients and your schedule is booked. But somehow your no-shows seem to be occupying more of your time than the patients you actually see and you’re finding out too late that some patient’s health insurance is not covering certain procedures or visits. Patient invoices aren’t being paid, missed appointments are piling up and unbillable hours are becoming more frequent. Billing Precision, which is a web-based program, has been designed for chiropractors who want to make better use of their time and their dedicated staff’s energy. Its various features allow chiropractors to run their practice efficiently and profitably. Daily Management Challenges The hassles of daily management are huge. These include making sure patients move in and out of the office on time. No-shows, people arriving late because they have the wrong appointment time and patients whose insurance information has not been processed properly can all cost you money. Billing Precision includes numerous tools to ensure that each aspect of your daily practice is attended to properly. Using Billing Precision software, your staff will be able to move patients from the waiting room, into the examination room and then to their next step, which may be to undergo further treatment or to go to patient checkout where they make their next appointment and pay their balance. Although it sounds simple, many chiropractors offer various services that may include physical rehabilitation, weight and nutrition counseling and a medical fitness program. Now the daily running of a practice becomes exceptionally complicated. With Billing Precision’s system all of these areas can be coordinated. SOAP Notes EHR The other important aspect of a chiropractic practice that is addressed by Billing Precision is SOAP Notes EHR. These notes, which contain important observations and treatment information for each patient, are used to track patient and they include the doctor’s diagnosis and their plan for treatment. These notes are also required when a practice is audited by an insurance agency. If a doctor’s notes are incomplete, chances are the insurance agency will reject the claim and the practice will lose money. Some estimates indicate that 67 percent of audited insurance claims are rejected and that doctors lose hundreds of millions of dollars each year. Once a health insurance company sees that a practice is vulnerable to audits then chances are they will audit that practice again and again. SOAP Notes from Billing Precision are totally computerized and may be filled out accurately with a few touches of the computer screen. In a matter of seconds a chiropractor has accurate SOAP Notes that will stand up to any audit and those notes are all integrated into the Billing Precision system. Total Coordination A busy chiropractor’s office needs daily coordination to ensure that it runs smoothly and profitably. Billing Precision’s web-based software allows chiropractors to do what they do best, treat their patients while their office is run with precision.

Chiropractic Billing Network Effect – Billing Precision

The Genesis Chiropractic Software Network Effect is Explained! The Chiropractic Billing Network Effect is when a new rule or new insurance validation is created for one practice, it’s instantly applied to all of our client’s practices who have the same situation. This network effect greatly enhances your ability to be paid in full and on time by the insurance companies. Any previous issues are fixed with the new validation going forward for everyone. A cure for one becomes a cure for all. https://youtu.be/SmBPIvktVPQ

Chiropractic Doctors Find the Billing Software They’ve Been Looking For

Total Office Management Software Billing software for Chiropractors is about more than simply billing. If simple invoicing were all that was required by a busy chiropractic office, then management solutions would be simple to implement. But healthcare professionals such a chiropractors face big challenges when it comes to billing. That’s due to the fact that invoicing is not limited to patients. It also involves working with insurance companies, which can be a challenging process for a chiropractor’s office. Insurance Providers One aspect of billing that can be especially daunting for a chiropractor involves working with insurance providers. Many people base their ability to see a healthcare provider on the participation of their insurance company. Thus, one thing a chiropractor does not want is ongoing insurance audits that can tax their time and may also result in the doctor having insurance payments denied. With the easy to use SOAP notes from Billing Precision this aspect of invoicing becomes much less intimidating and much more productive. When an insurance company questions a claim and the complete SOAP notes from Billing Precision are submitted, approval and payment becomes virtually automatic. The ability to justify a visit easily via Billing Precision’s SOAP notes makes a chiropractor’s office more profitable and lessens the chance that more audits will occur. Patient Billing and Scheduling The chiropractic billing software designed by Billing Precision makes billing and scheduling fast and effortless. The online system is more than a simpler scheduler. With it, chiropractors may view, track and analyze every aspect of the scheduling and billing process. All parts of the process are totally coordinated, making it an invaluable tool for tracking patients and determining where and when the productivity and profitability of your practice is jeopardized. Updates and Adaptability Having a web-based program as the foundation of your chiropractic practice’s invoicing system makes it easy for you to update and keep patient records current. On the other end, that of the software provider, the fact that Billing Precision’s chiropractic billing software is online makes it easy for them to update information related to laws. Any change in insurance regulations can influence how a chiropractor interacts with insurance providers. This ability to quickly update software is a definite advantage for the user as any changes in laws can have a major effect on the likelihood of insurance claims being turned down or audited, which would result in more time spent on billing. Efficient in Every Way Billing software for a chiropractor must be highly adaptable and at the same time very stable. The best type of adaptable invoicing system lets the chiropractor alter the program so that it fits perfectly with their practice and the manner in which they do business. That same billing software also must be up-to-date all the time. If that ‘s the case, then the chiropractor will win every time.

What Makes Billing Precision Software Unique and Different?

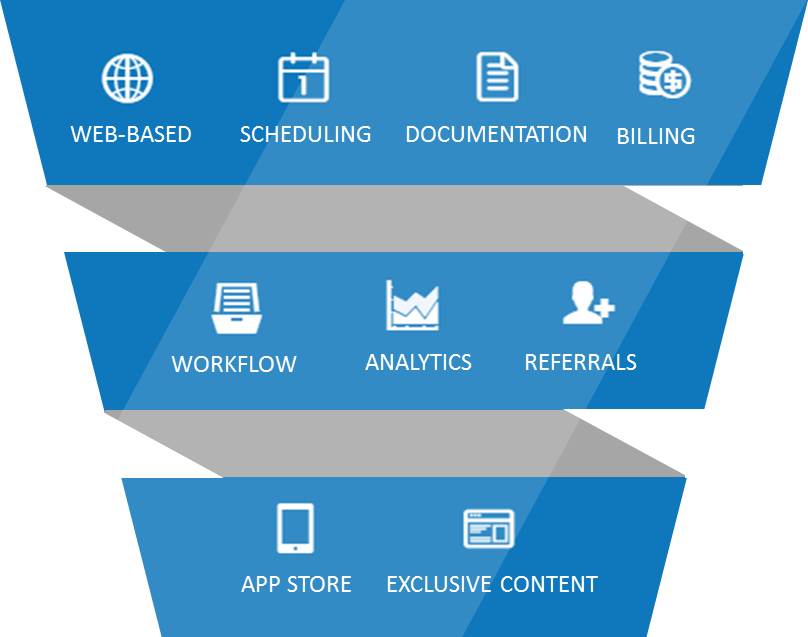

The most common question I get from prospective clients is, what makes Billing Precision so different for other chiropractic practice management software and/or chiropractic billing services? Results. Results that lead to shared immunity. The first difference is we started as a billing company. Chiropractors would go to our online system, choose a patient and enter the diagnosis and procedure codes. Since this was online we did the follow up and the doctor got real time access to not only the notes we made on our calls but also real time, dynamic, AR reports. This gave the doctor more control then when they did billing in house with all of the advantages of outsourcing. Since we were doing the billing the next thing we realized we needed from the doctors to process their claims, denials and medical necessity requests were SOAP notes. When we would request them they varied in format, in quality, and in turn around time depending on the practice. Worst case would be we would wait for a poorly written note that was difficult to read. We were losing tens of thousands of dollars and so was our clients. We had to create a SOAP system that was easy to use (create a soap in under 15 secs for our high volume) and would show medical nec. We had to win appeals. We don’t get paid unless the doctor does. So where most systems are built for aesthetics, ours are built for function and results. That brings me to the next big differentiators. Web based Network Effect. Think of this as sharing an immune system. Imagine your friend getting a cold and you getting the antibody so you never have to personally suffer. When we find a change the insurance companies make because of one practice or group of practices, we add a rule into the system that prevents all other doctors from making that coding, documentation or office procedure error. Our system is shared by hundreds of chiropractors across the country. Some low volume, some as high as 2000 per week. When we learn anything and build the entire network benefits, including you. That is how this system/methodology is developed. On real field results that affect the real bottom line. Fundamentally, that is different than all others. Another difference is, Billing Precision staff including management use the same exact system to manage our patients/relationships. Why, because it is the best system to manage relationships. How many other software or billing companies can say they use the same schedule and documentation system their clients do? We do! What do I mean by relationships? We see the value of a client as more than just the number of months they stay with us times the amount we collect from them on average. We also factor that an average client will refer a certain number of other clients over their lifetime with us and therefore we do not focus on a lot of external marketing. We focus on strong relationships managed by our profitability coach. We measure our success in referrals. The system alerts our coaches when a relationship is at risk based on warning signs. The system finds the risk and generates a ticket or a task and assigns it to the correct person. Each day we are reviewing how many risk items there are. We can see The number of risk events (No shows, No Future appointments) If we are keeping them under control If not who or what is the greatest risk to relationships. In other words, is there a backlog of tasks because of a broken office process like recalls or is one of our team members overwhelmed? There is 3 main types of risk that can be managed this way Patient Retention Revenue Compliance In order for a system to help you manage theses risks by creating tasks, all of its parts would have to be integrated. Scheduling, Documentation, Billing, and Compliance. Can you see the value of having thousands of doctors on a web based system and using the immune system principle to strengthen the methodology and technology? To see if Billing Precision is a good fit for you we will need to ask you a lot of questions. Not just about a stand alone system like soap notes. We will need to understand all of the systems you use today to manage your patient relationships.

Chiropractic Billing Stimulus and Network Effect For Practice Profitability – Dr. Troy Dreiling

https://youtu.be/C7BKPJYqdew Hi I’m Dr. Troy Dreiling from Zenaptic Chiropractic, here in Vancouver Washington. Today I want to talk to you about growing our billing and practice management network. First of all I’m really grateful for my really good friend, Dr. Chris Zaino, who referred me to Billing Precision over three years ago. If it weren’t for that referral I would probably be out doing something else because I wouldn’t be sleeping, I would be worried about compliance, growing my practice, cash-flow, patient management, and patient flow. Next I want to tell you that I refer all my friends to Billing Precision. Not only are they delighted that I referred them, but my cash-flow improves. One of the things that is exciting about this is that we all share the same billing CNS, or central nerve system. Every billing rule applies to every member. So it’s like this, if we have a shared immune system or central nerve system, I develop a cold and build the antibody towards it, you are actually protected. You get the same antibody. Now if we don’t share the same immune system or central immune system, I get a cold and I have to build the antibody. No matter how many cold I get, I’m building the antibody, you’re not protected. You have to build your own antibodies on your own. Now if two of us share the same immune system or central nerve system, I get a cold and you actually get the antibody from it. So we are going to get half the colds, but imagine this. Imagine if we have 1,000 people sharing the same central nerve system or immune system, I get the cold, I develop the antibody from it, you’re protected from that cold. All 1,000 members are protected. Back to the insurance business. You know that the insurance companies make their profit on the float, and periodically they’re going to change the rules to the game, so it’s hard for us to get paid and slows down the profitability of your practice. Now if a 1,000 customers share the same billing central nerve system, it’s only going to take one of us to take it on the chin to develop a rule change so all the other members can share. Why? Because it’s like a shared immune system. So any time there is a rule change Billing Precision creates the antibodies for it and then we’re all protected because we share the same nerve system and we avoid the damage. Billing Precision’s shared CNS creates the network effect, plus when you refer you can receive Billing Precision’s profitability stimulus. So why wait? Make a referral to Billing Precision today to improve your own cash-flow and compliance.

Chiropractic Billing Software Solutions For Your Practice

If you’re a chiropractor that is in a joint practice or that has various offices, you may find it difficult to track important billing information. Reports on a patient may be accessible from one office but not accessible at all from the other. Or you may not be able to incorporate your SOAP easily and quickly with your chiropractic billing software. In both cases, the profitability of your office is compromised. An invoicing system that allows for total access and ease in adaptability offers true solutions to a chiropractic practice. Office Coordination One of the most taxing aspects of running a chiropractic office is coordination of all aspects of that endeavor. Patient cancellations, rescheduling patients or no shows can create a situation where a doctor’s unbilled hours are mounting, putting stress on their entire enterprise. Billing Precision software provides practitioners with various tools that allow them to coordinate all aspects of the scheduling, exam and billing process. One aspect that is especially useful is their totally automated system designed to remind patients of upcoming appointments. This greatly reduces no shows, helping to make a practice more profitable. Reports on Day’s Events One feature of the chiropractic billing software from Billing Precision that greatly helps to increase the productivity of an office are the daily reports generated regarding no-shows, cancellations and other aspects of the work day. These reports aid in identifying areas in which a practice is being inefficient and unproductive. Additionally, these reports can be coordinated with patient profiles, demographics and other data. The ability to monitor each area of the scheduling process is especially useful in developing a profitable practice. SOAP Notes that Work SOAP notes from Billing Precision are filled-in with a few clicks of your computer while talking with a patient. The information is instantly recorded and may be accessed from any office or computer. These notes not only help in tracking a patient’s progress, they are essential if an insurance claim is being audited. The information contained in these SOAP notes can be the difference between winning and losing an audit. The notes are completely integrated within the system and offer effortless and seamless access. Home Free In a way, those who use the chiropractic billing software from Billing Precision start to feel as if they are home free when it comes to office management. This web-based program is totally devoted to making sure your office runs smoothly, is productive and has every opportunity to turn a sizable profit. This program, which is highly configurable, is as comprehensive as can be. Plus, as healthcare changes, it will keep pace with those changes, making it a tool for the future development and profitability of your practice. The Billing Precision software has been re-branded Genesis Chiropractic Software and this blog is on the website.