SWAT outsmarts payers to resolve billing issues

Beating the insurance companies at their own game can be extremely frustrating and time-consuming for chiropractors who want to improve the cash flow at their clinics. Even when a provider makes time to deal with the payers instead of treating his patients, he usually lacks the necessary expertise to resolve any issues and often ends up losing massive amounts of profit due to delayed, denied or reduced payments for submitted claims. So, when the going gets tough and a provider finds himself overwhelmed by complex billing issues that keep him from getting paid, Genesis’ SWAT (SPOCs With Attitude and Training) Team steps in to save the day and discover underpayment and delay tactics in massive volumes at the request of the provider’s account manager (a.k.a. SPOC). By analyzing large amounts of data to discover trends for underpayments and delay tactics SWAT puts the combined expertise of over 50 years of billing, practice management, and Vericle experience to use to come up with creative solutions to counteract the payers’ tricks and outsmart them. These solutions are then shared and implemented as concerted effort by multi-specialty teams, including practice managers, billers, account managers, audit and quality assurance managers, systems development, customer support, and the technology team who focus on large-scale problems. The SWAT team is not geographically limited in any way and works effectively to solve chiropractic cash flow issues across multiple states and specialties regardless of any differences. As case in point, SWAT helped a practice collect $5,418 in payments after months of not receiving any money for submitted claims in spite of being re-credentialed as group provider by Medicare. The solution consisted of correcting an incorrectly entered provider’s Group NPI number so that the practice can now enjoy steady income from Medicare. In another example, SWAT helped a practice increase their income from $600 to $15,147 by discovering and correcting inaccurate data that had led to denied claims. These corrections also resulted in steady income from Medicaid and significantly increased profits. Ultimately, Genesis’ billing SWAT team will go to bat for the practice owners against any and all payers who try to avoid paying what they owe for claims.

Are you paying more for your chiropractic billing than it’s worth?

Your chiropractic billing software or billing company may cost you more than it is worth if your collections are consistently low and many of your accounts receivable (AR) are more than 120 days past due. Since your clinic’s profitability greatly depends on speedy and proficient billing performance, the billing fees are actually not as significant as the total amount of collections received in one month when determining the true value/ROI of your billing service/software. Granted, the salary of an in-house billing staff member may cost you less than the fee collected by a chiropractic billing company. But chances are, the billing company can achieve a higher amount in collections each month due to better tools such as sophisticated billing software and a network of employees with more combined professional experience. In other words, you will get what you pay for, but in the end the potential for building your dream practice with greater profits increases when choosing a billing company in spite of higher fees. If you think buying chiropractic billing software to be used by your in-house employee will save you money on billing fees, think again. Ultimately, you will still lack the manpower to fight the payers, just as you will lack the resources to stay on top of technological advancements. Software upgrades don’t come cheap and the insurance companies are notorious for changing codes frequently to throw a wrench in your billing game. Last but certainly not least, the risk of never ever getting the money you are owed for chiropractic claims increases significantly once the AR hit the 120-day mark. You can basically consider these claims to be “dead” charges and start looking for a way to speed up your billing process to prevent this from happening again. Here is how you can compute the true cost of your chiropractic billing fees: Profit = Collections – Billing Performance Loss – Billing Fees Where: Collections: total amount of money received from insurance companies Billing Performance Loss: all claims submitted (AR) that are 120 days past-due Billings fees: money charged for the service Example: Assumptions: Your current fees are 5%. Your current collections are $100,000 Your current AR beyond 120 days is 20 % Potential fees are 8% potential AR beyond 120 days is 10 % –> What is the new performance? How much more money will you have? A) What is the improved collection? Calculate improvement in performance by subtracting new AR percentage past 120 days (10%) from old AR (past 120 days) of 20%: 20%-10%=10% improved collections percentage B) What is the potential collection? Calculate dollar value of potential improved collections by adding 10% (improved collections) to current total of $100,000: $100,000 + $10,000=$110,000 potential collections C) What is the potential profit? Calculate the current profit by subtracting $5,000 for service fees from $100,000 in collections, resulting in $95,000 in current profits: $100,000-$5,000=$95,000 current profit (assume 5% fees) Determine $ amount of new fees by multiplying improved collections of $110,000 by 8-percent fee resulting in the amount of $8,000 for new fees: $110,000 x 0.08 = $8,000 new fee Calculate improved profit by subtracting billing fees in the amount of $8,000 from the improved collections of $110,000, resulting in improved profit of $102,000: $110,000-$8,000=$102,000 improved profit D) How much will the profit increase? Overall bottom line improvement of $102,000 – $95,000 = $7,000 more in spite of the higher fee! Ultimately, the best solution would be to use a chiropractic billing service network that can leverage the network effect of accumulated knowledge and man-power against the payers and get you paid faster.

ChiroFutures adds health plan billing error defense coverage for chiropractors

>The insurance company, ChiroFutures Risk Purchasing Group, now offers Health Plan Billing Error Defense Coverage as part of its Chiropractor’s Malpractice Insurance Program. ChiroFutures Co-Founder Dr. Matthew McCoy said, “We are pleased to provide our clients with this enhanced coverage at no additional charge. We know the special risks chiropractors face in their professional endeavors and we are able to offer insightful risk management advice and tools, as well as insurance products that meet a chiropractor’s specific needs.” In particular, that means chiropractors will be able to get coverage in emerging areas of liability, such as Regulatory Board Defense, Medicare/Medicaid Billing Error Defense, Information Privacy Wrongful Acts, and Peer Review Committee Defense. For more information about the Chiropractic Professional Liability program, please contact Teresa Quale, Sonoran National Insurance Group, at teresa.quale@sonorannational.com or (480) 538-7173.

Genesis Chiropractic Software and Billing Integrates with PostureScreen Mobile

PostureScreen and Genesis Chiropractic Software and Billing, both CBP® Preferred Products, integrate to add mobile phone application dimension to practice management, patient education, and billing. Now with one touch of the screen from the iPhone, iPad, or Android application, the PostureScreen® Mobile report and images are instantly uploaded to the patient account inside Genesis! This integration is available to all Genesis/Billing Precision clients and PostureScreen® clients at no extra charge! Click the image below to request an email with step-by-step instructions. Start using the integration right away. Watch a video of the integration! Dr. Joe Ferrantelli and Dr. Brian Capra Filmed at the Ideal Spine Institute, CBP headquarters in Eagle, Idaho. https://youtu.be/8sIHrzS7Gh Dr. Jason Haas’ Testimonial More information on the integration View the full official press release here: http://www.prweb.com/releases/Chiropractic-Software/Billing-CBP-Posturescreen/prweb10012113.htm

Genesis Chiropractic Software and Billing Hosts Garrett Gunderson Webinar

Genesis Chiropractic Software and Billing Hosts Garrett Gunderson Webinar Attend this free teleseminar with NY Times Best-Selling Author Garrett Gunderson to… Expose Your Financial Blind Spots that are Leeching Your Cash Uncover the “Duh” Areas You Can Tweak to Take Home Thousands More RIGHT NOW Without Working Harder Seems like the harder you work the harder it is to actually enjoy your money, right? You keep thinking, “I just have to see more patients. I have to perform more procedures. Then I can have more money to relax and live my ideal lifestyle.” Will you forgive me for (lovingly) smacking you upside your head? That thinking leads to a stress-filled, never-ending treadmill of long, hard days and ultimate burnout. Your problem isn’t that you’re not working hard enough. It’s that your money is draining out of simple holes that can be plugged with some financial savvy. You’re a health and wellness expert. But what you don’t know about the financial side of your business is costing you thousands of dollars per year—and quite likely per month. As a financial advocate to 217 chiropractors and a New York Times best-selling author, I can confidently proclaim that you can live your ideal life now. You don’t have to scrimp and sacrifice, waiting for that elusive “someday.” You don’t have to work harder. You’re already earning all the money you need. Now let me show you how to keep and leverage more of it. Consider: In a recent analysis by my team of financial experts, 107 of 117 chiropractors were overpaying on their taxes—in many cases tens of thousands each year. How much are you losing? What could you do with that money? Taxes is just one area of seven areas I reveal on this eye-opening teleseminar. Stop losing your hard-earned money to financial institutions and the government. Stop the madness of trying to achieve your ideal lifestyle by working harder. Register now for my November 8th, teleseminar. There’s no cost or obligation to attend. I’ll teach you how you can reposition your assets to increase your cash flow, reduce your risk and stress, and have more fun immediately without working harder. -Garrett Gunderson, Financial Advocate & Author of Killing Sacred Cows: Overcoming the Financial Myths that are Destroying Your Prosperity What you’ll learn isn’t theory. Hundreds of chiropractors and wellness professionals are applying these specific, concrete strategies to free up thousands per month. In fact, just last year I recovered $7,705,300 for 217 chiropractors. We save an average $2,573 per month ($30,876 per year) for our chiropractor clients.

Hurricane Sandy on Path for NJ – Data Center for Genesis Chiropractic Software and Billing Preparing

Hurricane Sandy is headed right for us. What we are doing to keep your data and limit service interruption. What should you do? What should you do: (VIDEO) https://youtu.be/JWrYTRd3GGc What we are doing: We are preparing for what can be potentially the worst storm to hit the north east in many years and taking it very seriously. The center of Hurricane Sandy is headed straight for New Jersey. Many of our clients have expressed concerns about their data. Here is break down of the potential risks as well as the measures being taken to guard against service interruptions. Power The data centers where your account data is stored are state of the art. Servers have UPS battery back ups should the power suddenly go out. If and when power goes out massive generators turn on and can keep the data center power up and running indefinitely. There is enough fuel to run the generators on site for three days. In the meantime fuel vendors continue to replenish the diesel supplies on a regular basis. Data Loss Data is always backed up on multiple servers within the main data center and again offsite at our Tampa area headquarters. With power outage and surges being the biggest threat to the security of the data we suspect that this is the lowest risk we face because of the storm. In the event the data center is totally destroyed the data backup in Tampa will serve as a temporary replacement. Connectivity The biggest concern we have is loss of connection to the internet between the data center and the internet. This would you would not be able to access the system for that period of time where the connection is lost. Your access to the system is dependent not only on your local connection to the internet but also the data centers connection to the internet. In Billing Precision’s history we have never experienced a loss of connectivity to the system because of a loss of connection between the data center and the internet. This is due in part to internet connection redundancy, meaning there is more than one type of connection between the data center and the internet. It would be similar to your office having DSL, Cable, and T1 connection. If one would go down there are always two others. For the data center there are also some other safety measures in place for connectivity. All this being said we have never faced a situation where the data center took a direct hit so connectivity, regardless of the precautions we take, is a real concern. Loss of connectivity is a real possibility. A message from Net Access, our data center We have increased staffing levels for both onsite and on-call personnel next week to ensure proper coverage in the event that an emergency response is necessary. We have also completed readiness checks of our emergency power systems including UPS’s and generation plants. Our fuel vendors have been notified and are on standby ready to provide additional fuel in the event of a long term utility power disruption. Throughout the event, all systems will continue to be monitored as usual. Additionally, the Facilities and Operations teams will be performing an increased number of visual inspections of building structure and all critical systems. Our thoughts and prayers are with everyone affected by Hurricane Sandy, Brian Capra DC President, Billing Precision, LLC

Genesis Chiropractic Software and Billing User Support and Help System

The help system is built-into Genesis Chiropractic Software and Billing training and that support has 4 main types: Help Training Academy is online for easy access. Support Tickets with your Coach and your Billing Team. Live Help Sessions conducted by your Training Team. Content Specific Help is available on each screen in the software. These four videos will HELP you see the benefits of each type of training. Training Academy https://youtu.be/AoTImElz8GI Help Tickets https://youtu.be/PhDzLj7n1nM Live Help Sessions https://youtu.be/sf_q248yVm4 Content Specific Help https://youtu.be/kAwewGIU7Sk

Genesis Chiropractic Software and Billing – EHR SOAP Note – Basic Training

Genesis Chiropractic Software and Billing (A product of Billing Precision, LLC) EHR SOAP note feature allows the user to quickly asses the patients condition from the previous visit and make fast changes to multiple parameters per complaint. 24 hour access to web based system. Do your notes from anywhere. Note templates are pre-configured based on real claim appeal data. Easy customization Fast creation of new note Daily visit note updated in seconds Dictation software ready – Dragon and Siri iPad Ready Touch Screen Ready Wow your patients with high tech look Full Stimulus eligible – Powered by Vericle which ICSA certified SEE VIDEOS BELOW Basic training videos cover how to: Create an initial subjective complaint Modify existing subjective complaints Objective findings such as: Posture Range of motion Palpation Orthopedic tests Vestibular test X-Ray findings Height Weight Blood pressure Updating objective findings for re-exams and subsequent visits Assessment Treatment Plan Customizing note templates Creating and using macros Training Videos Introduction to the SOAP screen https://youtu.be/fuvsvGA-Axw Subjective Section Basic Training https://youtu.be/j-hGJrEBBSc Objective Section Basic Training https://youtu.be/7YTFjTUut8M Assessment https://youtu.be/bAhAhOtHiTA

Genesis Chiropractic Software and Billing Precision Service Selected by CBP’s Dr. Deed Harrison for His New Office

Genesis and Billing Precision Service has been selected by Dr. Deed Harrison for his new 11,000 square foot, Chiropractic BioPhysics® (CBP®), Ideal Spine Health Center® in Boise, Idaho. Genesis will be used for patient relationship management, billing, compliance, marketing, and cash flow management. “We saw the need to centralize what we are trying to accomplish with CBP,” said Dr. Harrison, owner of Chiropractic BioPhysics. “Flying all over left me less and less time to do the research CBP was built on. I decided to build one facility where I can practice and continue to produce the latest research.” The Ideal Spine Health Center, scheduled to open October 20th, 2012 will be the first of its kind. On one side of the building will be a Chiropractic BioPhysics office. On the opposite side of the building the CBP Doctor Institute, and a 2,000 SQF conference center and training facility, which together totals 11,000 SQF. “We’ve designed an exclusive CBP documentation suite to allow full integration with CBP’s business modules from Drs. Haas, CBP technique treatment procedures, and x-ray (PostureRay®) and Posture analysis (PostureScreen Mobile®) software,” continued Dr. Harrison.

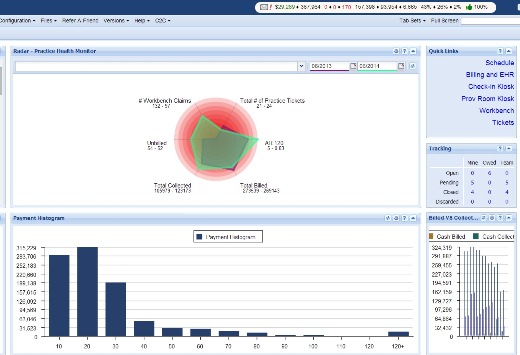

Genesis Chiropractic Software Outsourced Billing Option – Automation & Dynamic Reporting

“A billing service is a must for me. When I looked around for other options there were a few that said they had a billing service they could refer. Genesis Chiropractic Software and Billing was light years ahead in this category.” Dr. Deed Harrison – CEO Chiropractic BioPhysics Automation Genesis’ Billing Service, Billing Precision, has processed hundreds of thousands of insurance claims for chiropractors through the billing engine powered by Vericle technology. As claims are sent through the central database and their payment, underpayment, or nonpayment is analyzed. When a claim fails the system routes the claim to a biller for follow up rather than having billers look for claims in AR reports. Rules (over 2 million currently) are built into the technology to “flag claims” up front if a claim looks like it will not get paid or needs attention. In an environment where insurance companies are constantly changing their rules Genesis provides the infrastructure to leverage all of the claims data and optimize billing performance. This means that doctors using this system actually work as a team to beat the insurance companies at their own game just by using the system. All of the members submit our claims through this engine and it improves as we go. Whether it is 20 or 2000 doctors, this is a solution that can scale as more doctors join the network. Dynamic Reporting The massive undertaking of managing billing for hundreds of chiropractic offices forced Genesis/Billing Precision to create a dashboard that not only looks great but is functional. They use the same dashboard to manage their operations as practices us to manage their practice. The dashboard gives a high level visual representation of what is happening across key billing and patient relationship metrics. It is like a fighter jet cockpit. It highlights major threats to billing and patient relationship management. At first glance it can be overwhelming. That is why the Genesis Profitability Coaches are there. To help you asses the danger and right the course when needed. High level reporting is important as you fly but sometimes you have to stop and see what’s under the hood. Again, Genesis/Billing Precision uses the same reports you do to analyze billing performance. They have developed some unique reports that are not seen in other systems. One is called a MOS or Month Of Service report. This means you can see how much you billed month by month and, of what I billed how much is unpaid based on the moth it was billed in.