Show Me the Money!

By Reuven Lirov Chiropractic Practice Owner Struggles with Cash Flow What can Ben do to correct his cash flow problems?“You ready for lunch?” Ben looked up from the pile of bills on his office desk to see his wife, Carmen, standing in the doorway. “Only if you’re buying,” he said. “That bad, huh?” Carmen replied, closing the door behind her. “I’m a little surprised. On my way in, Pam told me that you’re booked solid.” “Patients aren’t the problem,” Ben said. “Revenue is. Seems like no matter how many adjustments I do, I’m never sure if I’m going to meet expenses that month.” “I thought you had someone who took care of billing,” Carmen said, perching on the edge of the desk. “Isn’t that their job?” Ben laughed, weakly. “That’s how I looked at it. And if it were just a matter of a few patients with payment issues, I’m sure my staff could handle it.” “Then what’s the problem?” “It’s a combination of collecting from insurance companies and then figuring out what the patient owes. Seems like we have to chase after the insurance companies for every dollar we’re due.” “I don’t get it,” Carmen said. “Your staff files the claims. Doesn’t that mean you automatically get paid?” “I thought so,” Ben said. “But I guess that’s why I’m a chiropractor and not an accountant. Come on, I need to get out of here.” Ben wasn’t really in the mood for lunch, but he needed to clear his head. He and Carmen walked to their usual lunch spot and found themselves a booth. As they slid in, Ben’s phone chimed. “What is it?” Carmen asked. “It’s a tweet from Richard,” Ben said, reading the display. “He says, ‘Life is a series of adjustments.’ Hashtag ‘chiropractics.’” “You spoken to him recently? His practice seems to be pretty successful. Maybe he can give you some advice.” “That’s not a bad idea,” Ben said, sliding back out of the booth. “I’m going to give him a call. If the waitress comes, order me a turkey reuben.” It took a couple of days before Ben and Richard could carve out some time. Finally, they got together on Saturday, when Richard was cleaning out his garage. “It drives me crazy,” Ben said. “Cash flow is so inconsistent. Feast or famine, and I never know which. Sometimes the drought lasts for weeks, no matter how many patients I see.” “You’ve got to get down to brass tacks,” Richard said, hanging his hedge trimmer on the pegboard. “Figure out what your best sellers are.” “My what?” “Your moneymakers. Start by checking which CPT codes, POS items sold, referring physicians and employee productivity generates the highest revenue in the shortest time possible.” “I’m guessing my billing department could help me with that,” Ben said as he coiled up an extension cord. “There are no guarantees,” Richard said, “but that’s what works for me. For instance, you want to avoid using the worst CPT code for the best payer. And trust me; once you’ve gotten your system straightened out, you’ll be better equipped to make vital practice decisions.” Should Ben follow Richard’s advice? What can Ben do to correct his cash flow problems?

Chiropractic Billing Compliance | How to audit-proof your practice

An Audit Proof Practice is what Dr. Ben needs. That was definitely NOT money well spent. Ben felt red-hot anger building up inside him like boiling lava in a volcano right before its eruption. He still had a hard time accepting that Blue Insurance fined him $30,000 for failing the audit and made him refund the payments he had received for all failed claims. He promised himself that he would do whatever it takes to reduce his audit risk from now on. “Given the volume of claims, an automated monitoring system may be the only practical way to detect suspicious conduct or potential flagging for audit,” Ben read out loud from the book Practice Profitability. That made perfect sense to him. He had been racking his brain for ways to implement his friend Tom’s advice of tracking the notorious red flags for insurance companies: unsigned notes, unbilled visits, missed re-exams, and denied claims. An automated monitoring system sounded like a life saver to him. “Does your chiropractic software help you stay compliant?” Ben asked Tom. Tom was a successful chiropractor who had been through several audits, but always seemed to emerge unscathed. “Absolutely,” Tom said. “There are just not enough hours in the day to help my patients and track all potential compliance issues manually.” “But how exactly does it help you?” Ben asked. “I wonder what kind of system would be the right choice for my clinic since I am not exactly a tech whiz.” “Don’t worry,” Tom said. “You just need to find a system with several useful features that are built around your workflow. The idea is to make your life easier, not more complicated.” Ben thought about that for a minute. He had been looking for ways to simplify managing his practice. But the most pressing issue for him right now was staying compliant. “Could it cut down my error rate?” Ben said. “Definitely. Just look for chiropractic software that has automated alerts and built-in claims scrubbing,” Tom said. “Those features will help you fix any mistakes before you submit any claims to the insurance companies.” “So you are saying that your chiropractic software alerts you of compliance issues and helps you manage your entire practice workflow,” Ben said in stunned disbelief. “It sure does,” Tom said “I use the software to assign tasks to my staff with tickets and complete my notes while I’m still with my patients. This makes my life so much easier and saves me so much time. My favorite thing is the Radar on the homepage, which gives me a quick overview of my practice stats so I know what is going on in all areas at all times.” How would you advise Ben? Is there a way to audit-proof his chiropractic clinic?

Chiropractic Billing Compliance | Can you reduce your audit risk?

Ben was forced to put all of his plans on hold. After paying the $30,000-fine to Blue Insurance they would have to cancel their Euro trip for another couple of years. He hated disappointing his wife, Carmen, and their baby boy, Jonathan. It seemed like failing that audit last month would have a ripple effect on his financial situation for a long time. He was still trying to figure out how to return the money he had already received for his failed claims without bringing his practice cash flow to a screeching halt. Although he was concerned about the future of his chiropractic clinic, he held on to the hope that he could emerge from this audit risk nightmare with a better way to stay compliant. He just had to come up with a plan for making his chiropractic billing and documentation audit-proof. “Have you been worried about compliance since you got audited last year?” Ben asked his friend,Tom, whose chiropractic clinic was thriving after last year’s brush with disaster. “I am trying to figure out how I can improve my compliance so that I can avoid another failed audit.” Tom smiled and said:”Yes, of course, but I have learned that we really can’t avoid an audit and the audit risk. So I decided to cut down my error rate to reduce my audit risk. Chiropractors can absolutely not afford to have any unsigned notes, unbilled visits, missed re-exams, or denied claims as number one rule. So you have to find a way to track these meticulously.” “Ok, but it seems impossible to even remember all the different insurance protocols for each patient,” countered Ben. “It is so confusing to keep track of all the requirements, and just when you think you get it, they change everything again.” “That’s true,” Tom admitted. “And many of those so-called compliance experts give advice that is really difficult to implement, not to mention that they all tell you something different.” “So how can we get it right then?” Ben asked. “I can’t gamble with the future of my clinic and need a bulletproof process to stay compliant.” How do you manage your: Unsigned notes Unbilled visits Missed re-exams Claim errors

Can you afford to fail an insurance audit?

It seemed like things might get worse for Ben’s chiropractic clinic before they got better. Sure enough, he received another letter from Blue Insurance. This time they wanted him to pay back the money he had already received for the claims that failed the audit last month in addition to paying a hefty penalty of $30,000. “Why don’t you contact a chiropractic compliance expert,” Carmen suggested. “He might be able to help you figure out this audit fiasco without losing your clinic.” Ben was trying to appear calm as he responded: “I guess it’s worth a shot.” He did not want his wife, Carmen, to know how worried he really was. The truth was, he doubted that anyone could help him make it through this audit-nightmare in one piece. But at the same time he did not want to give up on his dream of having a chiropractic clinic so he could save as many people’s lives as possible. When he met the compliance expert, David, later that week, he did his best to stay composed as David prepared him for the worst case scenario. “You should be aware that Blue Insurance might blacklist you,” David warned. “And once they do that, all the other insurance companies will come after you like a pack of wolves. Then you will have to deal with even more audits and disruptions of your chiropractic billing cycle.” “Something tells me that’s not even the worst outcome,” said Ben. “Unfortunately, it’s not,” David admitted. “You could also lose your license, not to mention the legal fees you would incur if Blue Insurance takes you to court. In case you are convicted for fraud, you could also serve time.” Ben swallowed hard. He started thinking about his patients. Would his patients stay loyal throughout these fraud accusations? It’s not like they would understand how difficult the insurance companies made it for chiropractors to stay compliant with ever-changing regulations for chiropractic billing and documentation. His professional reputation was clearly taking a big hit. Would anyone still think of him as a stand-up guy who was not interested in cutting corners? “Is there any way to minimize the damage from this failed audit so that I don’t lose my entire patient base?” Ben asked. “I can’t blame people for not giving me any referrals until this is over. But I can’t afford to lose my current patients, too.” David sighed. He felt Ben’s pain and wanted to reassure him. But he had to avoid giving him false hope. Ben had to be ready for an uphill battle, no matter how ugly it might get, if he wanted to prevail. Have you ever been audited or do you know anybody who was audited? What was the worst part about it?

Chiropractic Billing Compliance | Can you avoid getting audited?

The audit of his chiropractic documentation a few weeks ago did not go well for Ben. Now he had to pay $30,000 as penalty, according to the letter he just received from Blue Insurance. Ben felt angry as he crumpled the letter in his hand and said: “Where am I going get this kind of money?” His wife, Carmen, stopped feeding their 8-month old baby boy, Jonathan, for a moment to look at Ben. The dark circles under his eyes were a testament to his many sleepless nights this month. She was concerned, but did not want to add fuel to the fire. He was already stressed out enough. This fine came at the worst time possible since she was still staying home with the baby and wasn’t able to alleviate her family’s financial burden with an additional income. In spite of her MBA she had no helpful business advice to offer either. She felt helpless and powerless as she watched her husband struggle with this new burden. It all started three weeks ago when Ben received a notice from Blue Insurance to review the notes for chiropractic claims that he was paid in 2012. Apparently some of his patients had received inaccurate information due to sloppy accounting and complained, which raised red flags with the insurance company. Next thing he knew, the auditor was knocking on his clinic’s door to inspect the notes for those claims in question. Carmen suddenly had an idea:”Why don’t we meet your friend, Tom, who had to go through an audit last year? Maybe he can give you some pointers on how to deal with this situation.” Tom owned a chiropractic clinic in the same neighborhood and was happy to meet them for lunch. “I’m sorry you have to go through this, too, Ben,” he said. “Being audited and fined is no walk in the park, but don’t beat yourself up over it. I have learned that the insurance companies come after all chiros because they simply do not want to pay us. In fact, the fewer providers they have to deal with, the better. So they just try to blacklist as many of us as possible.” Ben was taken by surprise:”Seriously? Are you saying that anyone can get audited?” “That’s exactly what I’m saying,” Tom responded. “Audit penalties are pure revenue for the insurance companies. And just like every other business, they want to increase their profits. I read in this recent article by Palmetto GBA that chiropractors have a high error rate of 84.41 percent. That makes it easy for the insurance companies to come after us.” “So audits are pretty much a fact of life,” Carmen said flatly. “I just wonder if there is any way Ben can reduce his audit risk so that we still have money for diapers and the electric bill after the next audit,” she added half-jokingly. What do you think? Can audits be avoided, or is there at least a way to reduce your error rate as chiropractor?

Chiropractic Compliance | Check exclusions list to avoid denied claims

Dr. John Davila explains the importance of checking the LEIE or list of exclusions of individuals or/and entities for all staff members at your clinic to avoid chiropractic billing issues such as compliance risks and denied claims. Dr. John Davila talks about the significance of the List of Exclusions of Individuals and Entities for your chiropractic clinic in the video below: Cystic Fibrosis Services: $308,000.00. Radius Hospital Massachusetts: $334,000. Susony Hospital Puerto Rico: $382,000. Saint Francis Hospital Connecticut: $80,000. In a 6-week period of August 2013 the Office of Inspector General, recouped $1.2 million from these hospitals for one simple reason: someone on their staff was excluded from serving Medicare patients. My name is Dr. John Davila of Custom ChiroSolutions and today I want to talk to you about something very, very important that you should be looking at as far as compliance goes in your office. It’s the LEIE or list of exclusions of individuals or/and entities. Now, the reason this story is important is for a very simple reason, a couple years ago I had a client and he had a problem getting his Dr. his associate Dr. Registered with all these different insurance companies, and he couldn’t get the insurance companies to pay even out-of-network benefits and then he tried to get Medicare to register this Dr. and that didn’t work either. Next thing you know, he’s calling me going “Hey listen, I have all this money outstanding. I have these different issues.” We went in and looked and guess what– the first thing you do when you get a compliance manual is, check your employees. He didn’t know that. He didn’t know how. And that’s what we did for him. We came in and checked all of his employees and low and behold, the Doc he was trying to get registered was excluded about two years earlier from the Medicare program. Now the Dr. was cleared of all charges, he got his license back to practice, but Medicare didn’t let him back in. Major, major problem. So, what I want to do today was just bring this up because I think it’s really important for you understand that you need to check your employees. Now this Dr. didn’t know how to do it, we did. What we had to do was get him set up with a compliance manual and get this process going for him and that way he checked his employees. So if you’d like to know more about how to get a compliance manual in your office, especially to go ahead and check your employees on a regular basis, especially if they’ve been excluded from Medicare and if they’re on this LEIE list, let us know. You can give us a call at (800)-974-3479. If you dial extension 2 and ask for Stacy, she’ll go ahead and set you up for a free 30 minute consultation and we’ll get on the phone together, me and you and we’ll talk about how to get a compliance manual in your office. Now remember, call us now 800-974-3479 ext two.

Chiropractic Billing | Cut your learning curve with In-Context Help Pages

Help is there for you. The old adage that time is money certainly holds true for busy chiropractors who want to improve their clinic’s profitability by implementing new chiropractic EHR software. Naturally, they want to avoid going through an uncomfortable adjustment period of learning the required software features, as much as they want to prevent massive changes in their practice management routine. The obvious solution consists of Genesis’ software training system that allows users to learn on-the-go with in-context help pages. By accessing the appropriate training material right where and when they need it (on the feature page), the users can tailor their personal learning curve to their specific needs and time availability rather than having to go through overwhelming and ineffective lessons. This learning/training strategy can help chiropractors and their staff members implement new practice management/billing software in the least amount of time necessary to prevent loss of revenue. On the other side of the coin, it allows Genesis to continuously improve its software to help clients manage their practices’ more efficiently without losing revenue on expensive 1-on-1 training. It goes without saying that basic knowledge of software features and functionality by each and every staff member at the chiropractic clinic is a must in order to use Genesis chiropractic software the way it was intended– as time-saving tool that speeds up documentation and chiropractic billing processes. Furthermore, software support staff would not be able to help resolve even the simplest user issues when clinic staff lacks this kind of technical foundation. Using the In-context Help Pages to learn more about each of Genesis’ features can be accomplished by clicking the [?] whenever you don’t know how to proceed. A help page will open that explains everything you need to know about using that particular feature within Genesis software platform. Many of the help pages also include a video that briefly explains what the tab or feature can do for you and how you can use it. Users can also comment, edit and rate each help page to ensure that the power of Genesis’ network effect is passed on to every member in the form of shared knowledge. Simply click the “Edit” button on the left and type in your user tips following the guidelines that will be loaded onto the help page. For detailed directions on how to edit a help page, click the [?] within the help page on the right side to load a tutorial.

Select the right metrics to improve your clinic’s billing performance

How often do you rely on your intuition when selecting a Key Performance Indicator (KPI) for your chiropractic clinic to track? Have you ever avoided hiring a person who did not “look the part?” When it comes to practice management and chiropractic billing, looks might have nothing to do with the statistics that reliably predict performance. Most chiropractic clinic owners and office managers know that good management and performance improvement require measurement. “We can’t manage what we can’t measure” is a well-known adage. But measurement of one KPI does not always result in accomplishing your goals. If you make such a mistake once, you experience disappointment. If you repeat it several times, you get frustrated. Repeat your frustration enough times, and you will grow anxious about making decisions in the future. Anxiety can create feelings of worry, uneasiness, and dread. An indecisive chiropractic practice owner or practice manager is a poor manager. A vicious cycle gets created causing you to fail as a practice owner or manager and experience frustration and anxiety about your personal performance. A recent article in Harvard Business Review (M. Mauboussin, “The True Measures of Success,” October 2012, pp. 46-56) identified three cognitive biases that impede practice owner’s intuition and skew practice management decisions: Overconfidence Availability Status quo Overconfidence Our deep confidence in our own judgement is often at odds with reality. For instance, most people regard themselves as better-than-average drivers. This tendency readily extends to practice management, where a chiropractic clinic owner relies exclusively on charges for a chiropractic billing success metric. While a downward trend of charges may be indicative of a problem with shrinking patient visits or a broken charge submission process to insurance companies, its growth does not necessarily result in total revenues growth. Availability We often overestimate the importance of examples that are easily available, that are at the top of our minds, for instance when they are frequently repeated or they are most recent. In the chiropractic billing industry, the three most recently unpaid claims by an insurance company do not necessarily indicate that this insurance company has changed its policy, or that the chiropractic biller in your office has grown negligent with her duties. Status Quo Chiropractic practice managers prefer staying the course rather than facing the risks associated with change. This bias is in part a result of risk avoidance, a fear of loss even in the face of a bigger gain. It makes it difficult for a chiropractic practice owner to adjust the KPIs in a changing environment, caused by new insurance payment policies or sweeping changes like Obamacare. It also makes it difficult for the practice owner to shift his focus from acquiring new patients to better serving the existing clients, once the practice has achieved a critical mass and is able to start growing based on patient referrals. Which one of these do you think you could be guilty of? Please share your views and experiences in the comment box below.

Control Your Claim Flow Visually Using Radar Software

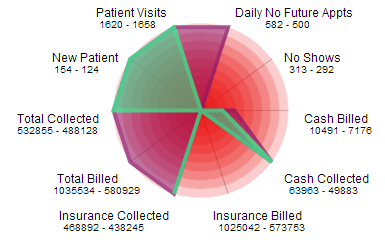

Do you worry about insurance claims payment delays? Lack of control over your chiropractic claims process causes inconsistent cash flow for your practice. If you cannot track and predict your cash flow easily you will have a hard time making your business profitable. You might even drive away patients when you are stressed out, which further hinders the growth of your chiropractic clinic. Ultimately, you cannot achieve any long-term profitability without sufficient growth. Since seeing patients is your priority, you can’t make time to micromanage each chiropractic billing aspect. Addressing the large amount of failing or rejected claims is virtually impossible with limited resources. Nevertheless, you need to follow up on your chiropractic claims to avoid reduced cash flow. Inconsistent and ineffective chiropractic billing performance can have many culprits including incompetent or untrained staff. But no one can adequately keep track and follow up on all underpaid and denied claims without effective chiropractic software. Not correcting these claims causes payment delays and can increase the percentage of your AR past 120 days. That’s why you need to track your active claims backlog and evaluate your chiropractic billing performance. Managing a chiropractic office is a balancing act of multiple Key Performance Indicators (KPIs), though. It can be challenging to prioritize tasks as many chiropractors tackle easy problems first before they focus on more complex matters. You need to keep your eyes on the big picture if you want to improve your claims workflow management and chiropractic billing performance. To accomplish this you need a centralized organization of tasks and performance. It is important to choose the right chiropractic software functionality. You should be able to look at multiple aspects of your practice at once, just like the snapshot Genesis’ Practice Health Monitor (a.k.a Radar) provides. To improve teamwork every member of your staff can also see this Radar chart on Genesis’ Home page every time they log on. You don’t need to waste time on compiling your practice stats, including claims status since data collection is automated. Furthermore, you and your staff can monitor trends to detect any problem areas before they cripple your practice performance. You can track your practice performance over time and measure any improvements with Genesis’ radar. But first you need to customize your workflow KPIs. Your Practice Success Coach then configures your radar to help you reach your goals.

Control Claim Flow Visually Using Radar Software

Do you worry about insurance claims payment delays? Peace of mind is hard to come by when you don’t have control over your chiropractic claims process since this affects your practice cash flow negatively. If you cannot track and predict your cash flow easily your business is doomed to die. To make matters worse, you drive away patients when you are stressed out, which further hinders the growth of your chiropractic clinic. Ultimately, you cannot achieve any long-term profitability without sufficient growth. Since seeing patients is your priority, you can’t make time to micromanage each chiropractic billing aspect. Addressing the large amount of failing or rejected claims is virtually impossible with limited resources. Nevertheless, you need to follow up on your chiropractic claims to avoid reduced cash flow for your practice. Inconsistent and ineffective chiropractic billing performance can have many culprits including incompetent or untrained staff. But no one can adequately keep track and follow up on all underpaid and denied claims without effective chiropractic software. However, not correcting these claims can affect the entire practice negatively since they will be forgotten and as such increase the percentage of your AR past 120 days. In fact, you need to track your active claims backlog in order to evaluate your chiropractic billing performance and AR. Managing a chiropractic office is a balancing act of multiple Key Performance Indicators (KPIs), though. It can be challenging to prioritize tasks as many chiropractors tackle easy problems first before they focus on more important matters. Instead of just putting out random fires you need to see the big picture consistently if you want to improve your claims workflow management and chiropractic billing performance. In order to do that you need a centralized organization of tasks and performance. Hence, it is vital to choose the right chiropractic software functionality. Naturally, your practice has a unique workflow that can only be supported by configurable and customizable chiropractic software. Yet, learning new chiropractic software can be a hassle many chiropractors would rather avoid. For that reason you should focus on ease of use for workflow management when evaluating possible chiropractic software solutions for your office. Moreover, all data should be displayed in an easy to digest way so you can complete a meaningful analysis on your own without wading through long and boring text reports. You should be able to look at multiple aspects of your practice at once, just like the snapshot Genesis’ Practice Health Monitor (a.k.a Radar) provides. To improve teamwork every member of your staff can also see this Radar chart on Genesis’ Home page every time they log on. You don’t need to waste time on compiling your practice stats, including claims status since data collection is automated. Furthermore, you and your staff can monitor trends to detect any problem areas before they cripple your practice performance. In order to track your practice performance over time and measure any improvements, you only need to customize your workflow KPIs. Genesis’ daily radar analysis and consistent follow ups in form of monthly Health Checks with your Coach further provide support to help you reach your goals.