Billing Solution for Chiropractors – Billing Precision

This new billing solution for chiropractors is one that levels the playing field with the insurance claim payers. Watch the video to learn more. https://youtu.be/lDgx3FqumoQ

Chiropractic Office Profitability – Billing Precision

Profitability: The only reason to stay in business is if your office is profitable or not. Dr. Brian Capra discusses Chiropractic Office Profitability and how it’s affected by Insurance companies and “the float.” The float is something that insurance companies don’t want you to know.

Chiropractic Office Management – Billing Precision

Chiropractic Office Management is a subject that we love. Our built-in tools will automate many tasks that slip through the memory cracks of office staff. Our Chiropractic Billing Software has built-in Office Management tools that will easily integrate into your office environment, especially because it automates many tasks that office staff can easily forget about. Chiropractic Office Management Video: https://youtu.be/z_Pi78TT62Y

All-In-One Chiropractic Billing Software – Billing Precision

Introducing the most extensive all-in-one chiropractic billing software that brings automation to your patients, insurance claims and office staff. Now, there’s an All-in-one Chiropractic Billing Software solution that also includes unique Practice Management tools. View the video for more. The software solution is a product of Billing Precision and it’s been named Genesis Chiropractic Software.

Chiropractic Practice Management – Billing Precision

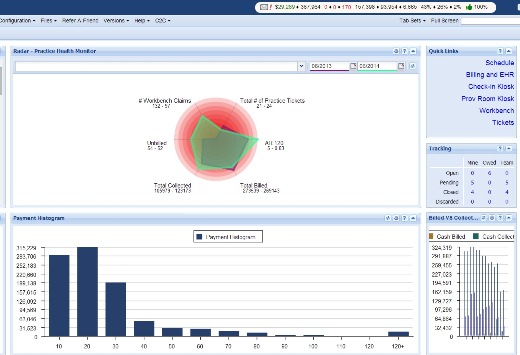

Chiropractic Software makes Practice Management easy. How? With built-in tools that turn data into at-a-glance numbers and graphs that enable fast recognition of each day’s business. A radar chart gives you a daily snapshot of the Key Performance Indicators (KPIs) that you use to run your practice. You can determine in seconds if your goals are being met. This tool is a particularly easy way to monitor your Practice Management. https://youtu.be/PaqKK7NmeOA

Billing Services for Chiropractors – Billing Precision

Billing Precision provided billing services for Chiropractors initially, but now the software works for other medical professionals as well. https://youtu.be/JKr5ljh1fwM

Chiropractic Billing Company Increases Insurance Reimbursement for Doctors

For years, chiropractors have had to battle insurance companies over payments, audits and fines. Billing Precision co-founder Doctor Brian Capra has developed a system that has dramatically increased insurance reimbursements for doctors. Dumont, New Jersey, July 5, 2011 — Doctor Brian Capra, the co-founder of Billing Precision, has developed a chiropractic billing and management system that has dramatically increased insurance reimbursements for doctors. The highly integrated, web-based system allows for the total communication between all business aspects of a practice. “One area,” observes Capra, “that has caused problems for many chiropractors and other health care providers is in the creation of SOAP notes. SOAP, which is an acronym for Subjective, Objective, Assessment, and Plan, are notes used by doctors to document patient maladies, including treatment. They are often requested by insurance companies and if a doctor has not kept accurate notes, they can end up either not being paid by the company or having to return payments. This is a major problem for chiropractors who have busy schedules and a large number of patients.” SOAP notes takes seconds to use and includes the ability to complete notes with just three touches of the computer screen. The notes become part of the patient’s Electronic Medical Record and can be used by the chiropractor within their office and with billing services and insurance companies. “What I discovered through my own experience,” says Dr. Capra, “is that insurance companies are focused on denying claims and auditing doctors who they see as being vulnerable to audits. SOAP notes, because they are so specific and complete, circumvent that strategy.” Dr. Capra adds, “By correcting processes connected to billing that chiropractors tend to overlook, Precision Billing has eliminated that vulnerability that often plagues chiropractors.” Billing Precision offers a complete system that includes programmable reminders, Point of Service alerts for co-pays, unpaid balances and referrals and simple and clear color-coded identification methods for types of appointments. Also included is the ability to schedule from various sites and for numerous providers, detailed reports related to all scheduling aspects, including daily schedules, load reports, missed appointments, free time, canceled appointments and the integration of patient demographics, billing and Electronic Medical Records documentation. Dr. Capra, whose degree is from Life University, has extensive practice management experience, seeing from 100 to 1,500 patient visits per week. He has also taken an integral part in the shaping of the service processes and automation requirements for Billing Precision to increase billing efficiency and overall practice profitability. He has written numerous articles as well as given many lectures on the subjects of practice management, compliance, and billing. Dr. Capra also wrote the foreword for the book Practice Profitability—Billing Network Effect for Revenue Cycle Management. This book sets the methodological foundation for the Billing Precision solution, explains the rules of the modern “payer-provider conflict,” and shows how to apply and manage winning Internet strategies, such as the “network effect,” to level the playing field with the payers.

Chiropractic Billing Software

Chiropractic Billing Software and Practice Management Tools. Billing Precision provides Chiropractic Billing Software and Practice Management tools for Chiropractors. The key is automation and the end of memory management for everything you keep in your head. It also means the end of management by fire. View the video to learn more. https://youtu.be/GpVmX1JRr4I

Chiropractic Practice Management Group Helps Doctors Outsource Their Billing

Coordinating Chiropractic Practice Management and Insurance Billing is Essential For years it has been exceptionally burdensome for chiropractors and other health care providers to handle billing effectively and economically. That side, the part that involves the business aspect, has taken a large number of resources, time and money to manage. Outsourcing chiropractic billing has become one option that many doctors have found to be helpful. Companies such as Billing Precision, which focus on helping chiropractors manage their practice, increase their productivity and earn more money, have discovered a new way to outsource that is groundbreaking. A Billing Methodology In creating a system for outsourcing that works, as it is with solving any problem, companies such as Billing Precision must first identify the problem and it’s source. Although it may be common to blame the insurance companies for problems related to claims that remain unpaid or are rejected, the fact is when it comes to chiropractic billing there are various places where the process breaks down and they are often connected with what the doctor’s office is doing. For years within the field, billing problems that originated with either the process, effort or attitude of the doctor’s office seemed endemic and needed to be cured. The specific problems being experienced by health care providers that were generated by their offices included insurance companies increasing denial rates, an ignoring of appeals and an auditing of medical notes that that resulted in requests for refunds and fines. When traced back to the chiropractor it was found that the medical office lacked a consistent and integrated billing methodology, used a billing service that did not follow through and did not identify reasons as to why their claims and bills were underpaid. Coordinated and Integrated Using the power of the Internet and computer to create a truly coordinated effort made the most sense. With that idea in mind, Billing Precision was able to develop a Web-based chiropractic practice management solution that included a highly automated and integrated system. In creating a system that would work for the provider, the company had to first understand the system being used by the payer. It is a system that would rather pay the provider less than more, that likes to hold onto provider cash and that would rather not pay at all. Knowing that, a software had to be developed that would conform to demands made by the insurance companies and a billing service had to be developed that the provider could easily maximize and that would integrate with outsourcing. Results Oriented With a commitment to being results oriented, the new billing system focused on reducing and eliminating as much as possible five primary strategies used by insurance companies. The insurance companies: 1. Created complexity and use new reasons for claim denials, which would increase doctor’s billing service costs. 2. Worked towards reducing fees allowed. 3. Consolidated the insurance industry to give them heightened leverage. 4. Underpaid claims as much as possible. 5. Returned claims for after-payment audits, which would result in a demand for refund and an imposing of fines. The decision to create a results oriented billing system with coordinated outsourcing defines exactly what a successful chiropractic practice management group like Billing Precision had to do to help remove the veil of contradictions and confusion with which practitioners were dealing. Increased Productivity The area of specialist in medical management and billing has been redefined by companies like Billing Precision. Making the medical practitioner’s job more productive by offering a real solution to a challenging problem. As the industry continues to develop and change, chiropractic practice management software and outsource providers will need to alter their programs and services in order to stay competitive. You are currently on the blog of Genesis Chiropractic Software, which is a product of Billing Precision, LLC.

Billing Precision Voted the Leader in Chiropractic Billing Software

Billing Precision has created a chiropractic billing software that has revolutionized the manner in which chiropractors run their business, increasing payments, offering more efficient use of office time and ensuring doctors have fewer unbillable hours due to patient no-shows. Co-founder of Billing Precision, Doctor Brian Capra, has developed a system that is winning praise from chiropractors around the country. Dumont, New Jersey, July 5, 2011—Billing Precision co-founder Doctor Brian Capra has worked with his partners to revolutionize chiropractic billing software. Capra, a chiropractor himself who still maintains his practice in New Jersey, intimately understands the challenges that practices face when it comes to billing. The software and system he has developed has been voted the leader by chiropractors across the country. “The chiropractor faces various complex challenges that are related to billing,” notes Capra. “The tip of the iceberg involves patient billing and record keeping with the wealth of the time consuming work revolving around enabling insurance company payments and reducing patient no-shows. Both of these aspects of billing and scheduling can greatly reduce the productivity and viability of a practice.” The integrative nature of Billing Precision’s chiropractic billing software is extremely effective. The web-based program is an all-in-one Internet-based system that includes accountable and transparent billing services, state-of-art touch-screen SOAP notes, advanced patient scheduling, and real-time monitoring for compliance and audit exposure. By covering all bases related to chiropractic management, Billing Precision has become the favorite of busy chiropractic offices. The software has been re-branded as Genesis Chiropractic Software. “An example of what we’ve done,” says Capra, “is the manner in which we’ve fully integrated the all-important aspect of SOAP notes. These notes are essential in tracking a patient’s health needs and progress. But they are also exceptionally important when it comes to securing payments from insurance companies and dealing with audits. We’ve totally automated SOAP notes, utilizing a state of the art touch screen that makes note taking fast and efficient. In a matter of seconds, a chiropractor can create a record of his appointment while with the patient. It saves times, protects against audits and fully integrates with all aspects of management and billing.” The company offers an integrated program that includes a highly interactive scheduler, SOAP Notes (which stands for Subjective, Objective, Assessment, Plan), EMR Documentation (Electronic Medical Records) and outsource billing services. Focused on a network solution, Billing Precision has developed methods and systems that allow for the highest level of collaboration among all elements of the management and billing process, creating a product that is total and complete. Dr. Capra, whose degree is from Life University, has extensive practice management experience, seeing from 100 to 1,500 patient visits per week. He has also taken an integral part in the shaping of the service processes and automation requirements for Billing Precision to increase billing efficiency and overall practice profitability. He has written numerous articles as well as given many lectures on the subjects of practice management, compliance, and billing. Dr. Capra also wrote the foreword for the book Practice Profitability—Billing Network Effect for Revenue Cycle Management. This book sets the methodological foundation for the Billing Precision solution, explains the rules of the modern “payer-provider conflict,” and shows how to apply and manage winning Internet strategies, such as the “network effect,” to level the playing field with the payers.