Chiro Match Makers: Chiropractic Practice Growth with Virtual Assistance

In the ever-evolving landscape of chiropractic practice, the key to success lies not only in clinical excellence but also in savvy business management. Enter Dr. Allen Miner, a seasoned chiropractor and astute entrepreneur, who sheds light on the transformative power of virtual assistance in scaling chiropractic practices. In this insightful conversation, Dr. Allen shares his expertise on leveraging technology and human resources to drive practice growth while reducing overhead costs. Harnessing Technology for Practice Growth: Dr. Allen’s journey into the realm of virtual assistance began with a realization: the traditional models of chiropractic practice often fell short in addressing the challenges of modern times. With an increasing demand for chiropractic services and a limited supply of qualified associates, Dr. Miner recognized the need for innovative solutions to propel practice growth. Through his company, Chiro Match Makers, Dr. Allen introduced the concept of Virtual Chiropractic Assistants (VCAs) to revolutionize practice management. Addressing the Supply-Demand Disparity: The chiropractic profession faces a significant supply-demand disparity, with five open jobs for every available associate. Dr. Allen’s data-driven approach revealed that many practices were struggling to afford competent associates due to outdated compensation models. By implementing behavioral assessments and understanding the unique needs of chiropractic professionals, Dr. Allen identified the necessity of reevaluating compensation structures to attract and retain top talent. Unlocking the Potential of Virtual Assistance: Recognizing the untapped potential of virtual assistance, Dr. Allen integrated VCAs into practice operations to alleviate administrative burdens and streamline workflows. From handling phone inquiries and scheduling appointments to managing social media and data analytics, VCAs proved instrumental in optimizing practice efficiency. By outsourcing low-value tasks, practice owners could focus on strategic growth initiatives and enhance the patient experience. Elevating Practice Visibility through Social Media: In an era dominated by digital connectivity, Dr. Allen underscores the importance of a strong social media presence in boosting practice visibility. VCAs adeptly manage social media platforms, engaging with patients, influencers, and local businesses to foster community relationships. By curating compelling content and leveraging collaborative partnerships, practices can attract new patients and cultivate brand loyalty. Empowering Associates for Mutual Success: Dr. Allen emphasizes the symbiotic relationship between practice owners and associates, advocating for fair compensation and collaborative growth strategies. By investing in top-tier associates and empowering them with the resources they need to thrive, practice owners unlock exponential revenue potential. Associates become integral partners in practice success, driving patient volume and revenue growth while fostering a culture of excellence. Conclusion: In an era of unprecedented challenges and opportunities, the chiropractic profession stands poised for transformation. Dr. Allen’s visionary approach to practice management, coupled with the strategic deployment of virtual assistance, offers a blueprint for sustainable growth and prosperity. By embracing technology, reimagining compensation models, and prioritizing associate empowerment, chiropractic practices can navigate the complexities of the modern healthcare landscape with confidence and success. With Chiro Match Makers leading the charge, the future of chiropractic practice has never looked brighter. Watch the full episode at https://bit.ly/3IBkniO

Bridging Balance: Chiropractic, Entrepreneurship, and Leadership

Embark on a dual journey with Dr. Lauryn Brunclik, a pioneering chiropractor and host of the “She Slays the Day” podcast. Explore the challenges faced by female chiropractors, including burnout and career choices. Then, delve into a captivating conversation with Dr. Brunclik on clinic management, balancing energies in leadership, and the path to success and self-awareness in the chiropractic and entrepreneurial realms. Gain valuable insights from these remarkable women on the multifaceted world of chiropractic and entrepreneurship. Setting the Stage: Dr. Brunclik takes us backstage, unveiling the genesis of “She Slays the Day” during her transition from coaching to podcasting. The podcast’s millennial vibe mirrors her modern approach to addressing challenges within the realm of female chiropractors. Shifting Focus: Originally tailored for supporting female chiropractors, the podcast evolved as Dr. Lauryn observed a broader trend. Burnout, a universal issue, transcended gender boundaries, affecting millennial and Gen Z males alike. The podcast transformed into a platform addressing universal concerns and welcoming a diverse audience. Navigating Burnout: Dr. Lauryn candidly addresses the burnout epidemic within the chiropractic profession. Practitioners, irrespective of gender, often express feelings of inadequacy and unfulfillment, highlighting a common thread of lacking joy in their careers. This segment provides insights into recognizing and addressing burnout for practitioners across genders. Freedom and Flexibility: The discussion expands to explore evolving perspectives on work ethic across generations. Dr. Lauryn shares her personal journey, emphasizing the importance of balance, freedom, and the ongoing struggle faced by older generations resistant to prioritizing well-being over relentless work. Relationship Dynamics: Dr. Lauryn opens up about her personal life, discussing her dynamic with her husband, a crucial contributor to the podcast. Juggling multiple roles as a chiropractor, business owner, and mother, she provides insights into how her relationships contribute to her overall success. The Masculine-Feminine Energy Balancing Act: As a seasoned chiropractor and podcast host, Dr. Lauryn offers practical advice for female practitioners. She addresses the common challenge of aligning business ventures with personal passions, emphasizing self-awareness, realistic standards, and finding joy in the chiropractic journey. Dr. Lauryn Brunclik introduces the concept of balancing masculine and feminine energies in both personal relationships and business leadership. While business demands a goal-oriented, masculine approach, she emphasizes the importance of incorporating feminine qualities like empathy, listening, and vulnerability for effective leadership. Lauryn shares her experience working with her husband in their business and the importance of maintaining a balance between masculine and feminine energies. She encourages leaders, irrespective of gender, to embrace feminine qualities for a more harmonious work environment. Business as the Bottom of Maslow’s Hierarchy: Reflecting on Maslow’s hierarchy of needs, Lauryn shares insights into the journey of chiropractors entering the profession. The challenges involve navigating financial concerns, survival mode, and constant problem-solving, forming a unique intersection of running a business and achieving self-fulfillment. The Chiropractic Dilemma: Associates vs. Clinic Owners: The discussion shifts to the challenges faced by chiropractic clinic owners in hiring associates. Lauryn explores the changing landscape where associates graduate with higher student loan debts, leading to difficulties in aligning salary expectations. The dilemma of salary structures is explored, emphasizing the need for clarity and fairness in compensation. Embracing Vulnerability and Empathy in Leadership: Delving into leadership dynamics, Lauryn advocates for a shift towards kind candor and effective communication. She emphasizes the need for leaders to create safe spaces for vulnerability and empathy in the workplace, fostering a culture of understanding and support. Conclusion: Concluding our discussion with Dr. Lauryn Brunclik, her valuable insights illuminate the entrepreneurial landscape, addressing challenges in chiropractic and emphasizing the balance of masculine and feminine energies in leadership. Lauryn’s wisdom guides the establishment of thriving practices and meaningful relationships in the field, encapsulating the essence of our conversation. This dialogue aims to inspire positive transformations within the chiropractic community and beyond, highlighting the importance of self-awareness and finding joy in one’s path. See the full episode by accessing it via https://vimeo.com/919756707?share=copy

The Smart Chiropractor: The Influence of Reactivations and Strategic Communication

Welcome to Genesis Nation, your gateway to the forefront of innovative chiropractic care and practice management. In this exclusive interview, we journey into the transformative realm of chiropractic marketing with trailblazing practitioners, Dr. Jason Deitch and Dr. Jeff Langmaid, co-founders of The Smart Chiropractor. As pioneers in reshaping the industry, they shed light on the often-overlooked goldmine within email lists and unveil the power of reactivations. The Genesis of The Smart Chiropractor: Delving into the roots of The Smart Chiropractor, Dr. Jeff Langmaid unfolds the founding principles that took inspiration from diverse fields beyond chiropractic. Their contrarian marketing approach aimed to simplify effective strategies for practitioners, starting with a focus on organic social media channels. Recognizing the untapped potential, they ventured into automated email marketing campaigns to enhance communication and drive reactivations. The duo addresses the common scenario where chiropractors possess substantial email lists yet underutilize them, emphasizing the importance of consistent communication to activate this valuable asset for practice growth. Reactivations: A Game-Changer in Chiropractic Marketing: Dr. Jason Deitch emphasizes the pivotal role of reactivations in alleviating stressors within the chiropractic profession, steering away from the constant pressure of new patient acquisition. With systems, processes, and automations, chiropractors can enhance practice sustainability. The power of predictive analytics takes center stage, allowing practitioners to anticipate outcomes based on email list size. This data-driven approach provides a strategic advantage, enabling chiropractors to navigate the competitive healthcare landscape with confidence. Addressing Burnout and Stress in the Chiropractic Profession: Dr. Jeff Langmaid expands on the holistic transformation observed in chiropractors adopting a reactivation-centric approach. The shift from reliance on new patient acquisition to managing schedules and revenue results in a significant reduction in stress and burnout. The conversation stresses the importance of building and maintaining relationships with existing patients, recognizing the ease and familiarity that comes with treating those already familiar with the practice. Navigating the Paradigm Shift in Chiropractic Care: Exploring the paradigm shift within chiropractic care, the conversation draws parallels between crisis-focused treatment and crisis-driven marketing. The Smart Chiropractor advocates for a more sustainable model, aligning treatment philosophies with marketing strategies. The focus shifts from the influx of new patients to calculating net momentum, considering reactivations and attrition as vital components of practice success. The Easiest Conversation: For Drs. Jason and Jeff, discussing the significance of email lists with chiropractors is remarkably straightforward. Emphasizing the need for consistent communication beyond occasional reminders, they stress the value of building relationships through engaging, inspiring, educational content. Teach and Invite Consistently: Differentiating between transactional texts and relational email communication, the duo introduces the concept of teaching and inviting consistently. They advocate for delivering value through content focused on the patient’s well-being, creating meaningful connections that transcend mere transactions. Know, Like, and Trust Factor: Transitioning to the ‘Know, Like, and Trust’ factor, Dr. Jason underscores that healthcare decisions are emotional choices. Building enduring patient relationships lies in continuous, welcoming communication, aligning seamlessly with the fundamental philosophy of chiropractic care. Conclusion: In the competitive field of chiropractic care, The Smart Chiropractor pioneers a data-driven, relationship-centric approach that transforms email lists into potent assets for practice growth. Embracing effective communication strategies, chiropractors can unlock the untapped potential within their email lists, revolutionizing patient engagement and fostering lasting connections. The insights from The Smart Chiropractor co-founders illuminate the transformative power of reactivations, offering a sustainable model that heals and propels the chiropractic profession into a balanced and fulfilling future. Watch the full episode at https://vimeo.com/919778041?share=copy

The Significance of Certified EHR in Modern Chiropractic Practice with Genesis Software

A New Era in Patient Data Management The journey of patient data management has been a long and evolving one. From the days of relying on sheer memory and manual record-keeping to the advent of digital solutions, the healthcare industry has witnessed a significant transformation. In this digital age, the introduction of Electronic Health Records (EHR) has revolutionized how patient information is handled, particularly in specialized fields like chiropractic care. Revolutionizing Chiropractic Care with Certified EHR The introduction of certified EHR technology marks a pivotal moment in healthcare, especially in chiropractic practices. Genesis Chiropractic Software incorporates this technology, focusing on enhancing the accuracy of patient data, streamlining communication among healthcare professionals, and ensuring the secure storage of patient information. Why Certified EHR Matters in Chiropractic Care Certified EHR goes beyond mere digitization of patient records. It represents a commitment to elevating patient outcomes through a structured and regulated technological approach. For chiropractors, adopting a system like Genesis Chiropractic Software ensures compliance with stringent standards like HIPAA and Meaningful Use, as established by CMS and the ONC. Moreover, it opens doors to federal incentives, aiding in the cost-effective implementation of EHR systems. Setting the Standards: Who Regulates Certified EHR? The standards for certified EHR systems are set by federal authorities, including the Centers for Medicare & Medicaid Services (CMS) and the Office of the National Coordinator for Health Information Technology (ONC). These bodies are responsible for ensuring that systems like Genesis Chiropractic Software adhere to the highest standards of quality and security. Understanding Meaningful Use in Chiropractic EHR For a chiropractic practice to comply with Medicare and Medicaid and to be eligible for incentive programs, an EHR system must meet specific criteria. These are divided into three stages: Data Management and Exchange: This initial stage is about effectively capturing and managing key performance indicators in a chiropractic setting, enhancing communication within the practice and with patients. Enhancing Clinical Processes: This stage focuses on improving electronic processes, including electronic prescriptions, access to online lab reports, and the digitalization of patient care summaries, along with an emphasis on Health Information Exchange (HIE). Optimizing Patient Outcomes: The final stage aims at showcasing improved health outcomes, facilitating better decision-making, and ensuring robust patient portal access for enhanced communication and information sharing. Transforming the Chiropractic Industry The push for certified EHR adoption, driven by Medicare and Medicaid incentive programs, has significantly influenced the chiropractic industry, nudging it towards a more universal adoption of digital health records. Genesis Chiropractic Software: Elevating Chiropractic Practices Genesis Chiropractic Software stands at the forefront of this technological revolution in chiropractic care. Our commitment is to assist chiropractic practices in navigating the complexities of Meaningful Use, HIPAA compliance, and other regulatory requirements. Whether you are in the market for a new EHR system or just considering an upgrade, Genesis Chiropractic Software offers a comprehensive solution that caters to the unique needs of your practice and patients. Explore how our software can redefine efficiency and care in your chiropractic practice.

The Network Effect

People handle adversity differently; some break down sooner than others. When a team focused on a common goal faces adverse conditions, dissent among some team members precludes them from reaching a shared goal. Under extreme conditions, a mutiny isn’t just mission-critical—it can leave everybody dead. The famous explorer Ernest Shackleton, best remembered for his Antarctic expedition of 1914–1916 in the ship Endurance, managed such risks by assigning the whiny, complaining crew members to sleep in his own tent and share the chores with him. Clustering the “complainers” with him minimized their negative influence on others, and this helped his team survive and accomplish their goals. Medicare Vs. Private Payers It’s essential to acknowledge the contrasting dynamics between Medicare and private payers. Medicare, as a government-backed program, follows distinct regulations and reimbursement structures, while private payers operate in a competitive market with more flexible terms. The negotiation strategies and considerations may differ significantly when dealing with these two payer types. Payment negotiations Actively negotiating with payers is crucial for independent medical practices. However, many providers lack experience or haven’t been successful in past negotiations due to inadequate preparation. To ensure a fruitful negotiation, it’s vital to: Know Your Data: Understand your practice-specific data, including patient volume, charges, reimbursement history, and more. Know the Terms of Each Contract: Familiarize yourself with your current payer-specific contract terms, especially the reimbursement schedule and the claims filing data. (Babcock, 2021) According to a KFF analysis, as seen in the image below, private insurers often pay nearly double the Medicare rates for hospital services. Specifically, for outpatient hospital services, private insurance rates were found to be significantly higher than Medicare rates, averaging 264% of the latter. This difference underscores the varying dynamics and market powers between Medicare and private insurers. Policymakers and analysts continue to debate the necessity of high payments from private payers to compensate for the lower Medicare payments. (How Much More Than Medicare Do Private Insurers Pay? A Review of the Literature | KFF, 2020) Classification of Payment Models Payment models dictate how healthcare providers, including physicians and hospitals, are remunerated for their services. Each model inherently carries incentives and disincentives that can influence the balance between cost reduction and improving care quality. These two objectives often stand at odds. This report delves into the implications of Alternative Payment Models (APMs) in either mitigating or intensifying health disparities. However, before exploring these implications, it’s essential to understand the incentives and disincentives embedded within the prevailing payment models. These incentives play a pivotal role in fostering cost-efficient, high-quality care. The primary distinction among these payment methods lies in the unit of payment. This determines how financial risk is distributed between the payer and the provider. The nature of this risk can significantly influence the behavior of healthcare providers and the overall efficiency and effectiveness of the healthcare system (Quinn, 2015). Factors affecting payment negotiations According to AMA, it’s not just about the rates but also about the terms and conditions that can impact payment. For instance, some contracts might have clauses that allow payers to change rates without notice, or they might have stringent requirements for prior authorizations. Providers should be wary of “most favored nation” clauses, which can restrict them from offering better rates to other payers. It’s also crucial to be aware of the dispute resolution process outlined in the contract, should any disagreements arise. By being well-prepared and understanding the intricacies of payer contracts, providers can position themselves for more favorable negotiations and better financial outcomes. (American Medical Association & American Medical Association, 2022) Payer-provider conflict In the payer-provider conflict, the providers who accept lower reimbursement and who don’t challenge underpayments or delayed payments make it easier for the payers to maintain their market control (oligopsony). Recent research supports this notion, indicating that payers with larger market shares have more negotiating power in contract negotiations (HealthPayer Intelligence). ClinicMind’s network helps providers maintain their payment schedules and motivation by establishing a shared discipline for clients and billers alike in terms of both thought and action. Payers with Larger Market Share and Their Negotiating Power Payers that have a dominant presence in the local market have a distinct advantage when it comes to negotiating lower prices for physician office visits. A study conducted by researchers from Harvard Medical School found that health insurance companies with a market share of 15% or more negotiated visit prices that were 21% lower than those set by payers with a market share of 5% or less. For instance, payers with less than 5% of the market negotiated prices of $88 per office visit. In contrast, those with 5 to 15% of the market share settled for a price of $72, and those with more than 15% of the market share negotiated even lower at $70 per visit. The graph below shows this analysis. From Policy Changes to Physician Consolidation In 2010, President Barack Obama signed the Affordable Care Act (ACA) into law, a move that expanded Medicare’s reach by adding millions to its coverage. This expansion meant that more physicians had to accept Medicare rates, which have been systematically reduced over time. The ACA not only aimed to extend healthcare access to uninsured Americans but also set in motion a wave of consolidation in healthcare services. As Medicare adjusted its rates, private insurance companies followed suit. While they still paid above Medicare rates, they too began to reduce their payouts. This trend forced physicians to grapple with a challenging reality: working more hours for less pay. The Power of the Network Effect In response to these financial pressures, physicians began to see the value in consolidating their practices. By joining larger organizations, they could harness the network effect, gaining more significant negotiating leverage with insurance companies. This consolidation is not just about survival; it’s about strength in numbers. Large groups, especially those with revenues exceeding $1 million annually, have more room to negotiate than smaller entities. The Rise of Management Service Organizations (MSO) Amidst these challenges,

Building Empires of Health

In the ever-evolving landscape of healthcare, few stories are as compelling as that of Dr. Jeff Danielson, a chiropractor, visionary entrepreneur, and the mastermind behind Big Fish Enterprises. In an exclusive podcast episode, Dr. Danielson shares the intricate details of his journey, offering listeners a glimpse into the unique blend of chiropractic expertise and business acumen that has propelled him to success. The Genesis of a Visionary: Dr. Jeff Danielson’s story begins in Minneapolis, Minnesota, where he not only thrived as a chiropractor but also cultivated a keen entrepreneurial spirit. It was during his interactions with students at a chiropractic school that he recognized a recurring pattern: young, talented chiropractors eager to make a difference, but often left unsupported after a brief stint in his practice. This realization led to the birth of an innovative coaching program. “Pay It Forward” Philosophy: The heart of Dr. Danielson’s coaching philosophy lies in the concept of “Pay It Forward.” He sought to break the cycle of talented chiropractors leaving after gaining experience and knowledge. Instead, he envisioned a system where associates would be mentored, trained, and ultimately become partners in the journey of acquiring and transforming chiropractic practices. This unique approach has not only benefited Dr. Danielson’s clinics but has created a ripple effect of success through the chiropractic community. Big Fish Training: Transforming Practices: The coaching program, aptly named Big Fish Training, was designed to turn ordinary practices into thriving enterprises. Dr. Danielson emphasizes a hands-on approach, pairing associates with him in his own practice, imparting not just clinical knowledge but the critical skills needed to run a successful chiropractic business. The goal is to transform practices from mere “Ford Taurus” models to high-performance “Lexus” clinics. Team Doc: Revolutionizing Community Engagement: One of Dr. Danielson’s game-changing innovations is Team Doc, a program that redefines community engagement and patient acquisition. By sponsoring local sports teams, especially those in unexpected niches like trap shooting, Dr. Danielson creates opportunities for meaningful connections. This unconventional marketing strategy has proven wildly successful, with dozens of new patients generated from each event, further solidifying the impact of chiropractic care in the community. Chiro Life: A Platform for Transformation: Dr. Jeff Danielson’s commitment to sharing knowledge and fostering collaboration reaches its zenith with the Chiro Life seminar. This annual event is a testament to his vision of building a community of chiropractors who not only excel in their practices but also inspire and support one another. The upcoming seminar, themed “Build Your Army,” promises to be a transformative experience, featuring speakers like Brian Capra, Jeff Langmaid, and Roberto Monaco. Conclusion: Dr. Jeff Danielson’s podcast episode is a masterclass in combining passion, purpose, and business savvy to create a lasting impact in the chiropractic world. His journey, from a chiropractic clinician to a mentor shaping the future of the profession, is an inspiration to aspiring chiropractors and entrepreneurs alike. As the chiropractic community eagerly anticipates the Cairo Life seminar, Dr. Danielson continues to shape the narrative of success in chiropractic care and business. To watch the full episode, you may view it via: https://bit.ly/3TK2qoS

Maximizing Chiropractic Practice Success

In today’s exclusive discussion, we have Michelle Corrigan, Director of Operations at Genesis Chiropractic Software, joining us. Michelle, a seasoned professional in the field, shares her extensive experience and valuable insights. Get ready for a deep dive into optimizing your practice management. Unlocking the Potential of Technology: In the chiropractic realm, Michelle highlights a common concern—practitioners may not be giving due attention to their bottom line. Genesis Nation aims to change this narrative by leveraging technology to streamline and enhance every aspect of your practice. Michelle is not just a Director of Operations; she’s a certified coder and compliance officer. With a wealth of experience, Michelle has witnessed the evolution of chiropractic practices, from manual HICFA forms to the seamless automation we enjoy today. Her insights are invaluable for those seeking to navigate the complexities of practice management. Bottom-Line Focus: Chiropractors often neglect their bottom line. Michelle emphasizes the importance of understanding the financial health of your practice. Genesis Nation encourages practitioners to use technology for robust financial management. Staff Training and Knowledge: The success of any practice relies on well-trained and knowledgeable staff. Michelle underscores the significance of hiring individuals who align with your practice’s values. Training staff effectively ensures that money doesn’t slip through the cracks. Underpaid and Rejected Claims: Every underpaid or rejected claim represents potential revenue loss. Michelle urges practitioners to intelligently combat these issues, preventing insurance companies from taking advantage. Genesis provides robust tools to fight for every dollar owed. Coding Accuracy: Coding is a critical aspect of chiropractic practice. Michelle stresses the need for a deep understanding of the relationship between procedure codes and diagnosis codes. Accurate and bulletproof notes are essential to support medical necessity. Network Effect in Billing: Michelle introduces the concept of a network effect in billing. Changes in one region may affect others. Genesis actively incorporates these changes into its system, creating a collective advantage for all practitioners in the network. Patient Payment Collection: Michelle addresses the challenge of collecting patient payments. While chiropractors are focused on healing, it’s crucial to ensure timely payments to keep the practice running smoothly. Innovative solutions like Chusa offer legal ways to provide discounts and facilitate payments. Avoiding Pitfalls in Contracts: Michelle shares a cautionary tale about contracts that promise quicker payments in exchange for reduced amounts. Practitioners need to scrutinize such agreements, ensuring they don’t inadvertently sign away substantial revenue. Conclusion: As we conclude this insightful discussion with Michelle Corrigan, Genesis Nation stands as a beacon for chiropractors seeking to revolutionize their practices. By embracing technology, focusing on financial health, and staying vigilant in billing practices, chiropractors can elevate their success. Join us on this journey of transformation, and stay tuned for more enriching discussions from Genesis Nation. To watch the full episode, you may view it via https://bit.ly/3S4ylPS.

How Practice Automation is Redefining Chiropractic Care

In an era where technology continually reshapes the landscape of healthcare, chiropractic practices are not left behind. The integration of practice automation into chiropractic care, as exemplified in discussions like the insightful interview with Dr. Aaron Gum of Blueprint to Practice Automation, is a testament to this evolution. This blog delves into the transformative impact of practice automation on chiropractic care, exploring how it enhances patient experience, streamlines operations, and opens new horizons for practitioners. The Rise of Practice Automation in Chiropractic Care: The concept of practice automation, as discussed by Dr. Gum, revolves around the integration of advanced technological systems into the day-to-day operations of chiropractic practices. This includes everything from patient management systems, electronic health records (EHRs), to automated patient education tools. The goal is to streamline administrative tasks, improve patient care, and ultimately, enhance the overall efficiency of chiropractic practices. Key Components of Practice Automation: Automated Patient Management Systems: These systems manage appointments, reminders, and follow-ups, significantly reducing the administrative workload and enhancing patient engagement. Electronic Health Records (EHR): EHRs provide a digital platform for storing patient data, facilitating easier access to treatment histories, and enabling better coordination of care. Digital Patient Education: Automating patient education ensures consistent and comprehensive information delivery, crucial for patient understanding and adherence to treatment plans. Remote Monitoring and Treatment: With advancements in technology, some aspects of chiropractic care can be monitored or even administered remotely, increasing accessibility and convenience for patients. The Benefits of Automation in Chiropractic Practices: Enhanced Efficiency: Automation reduces the time spent on repetitive tasks, allowing chiropractors to focus more on patient care and less on administrative duties. Improved Patient Experience: Automated systems contribute to reduced wait times and more efficient communication, leading to higher patient satisfaction. Scalability of Services: With automation, chiropractic practices can manage a larger patient load without compromising the quality of care, facilitating growth and expansion. Data-Driven Insights: The use of technology in practice management provides valuable data that can be used to make informed decisions about patient care and business strategies. Challenges and Considerations: While the advantages are significant, the transition to an automated practice requires careful consideration. Issues such as data security, the cost of technology, and the potential impact on the patient-practitioner relationship must be addressed. Additionally, there is a learning curve associated with new technologies that both staff and practitioners must navigate. Conclusion: The integration of practice automation in chiropractic care, as highlighted in discussions like Dr. Aaron Gum’s interview, is not just a trend but a necessary evolution. It offers a pathway to more efficient, patient-centered care, and a more sustainable business model for chiropractic practices. As we continue to witness technological advancements, embracing practice automation becomes not just an option, but a crucial step towards the future of chiropractic care. To learn more about Blueprint To Practice Automation you can visit them here https://bit.ly/bpa-genesis

Tasks, Checklists, and Problem Management

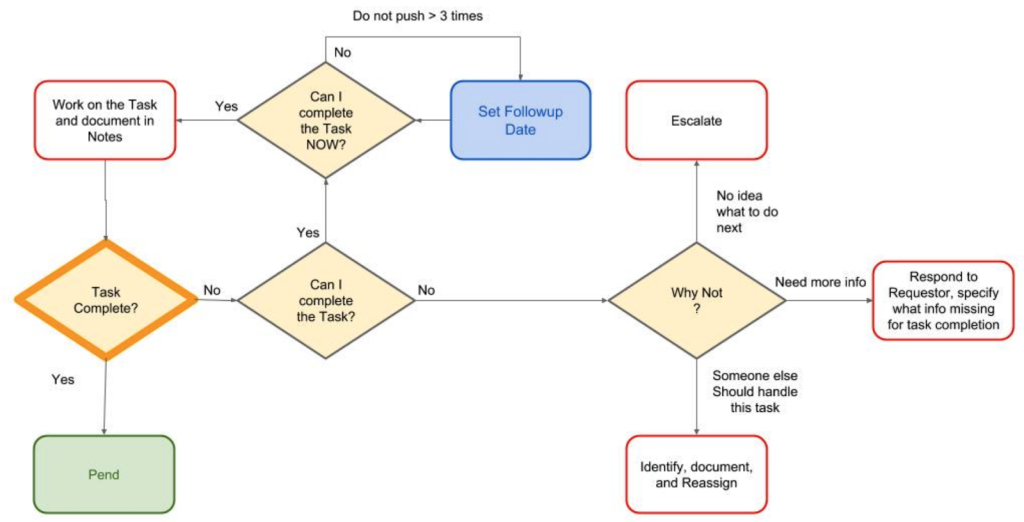

This blog chapter discusses the importance of standard operating procedures (SOPs) and checklists in problem resolution within the context of complex billing processes, with a focus on medical billing. It explores the characteristics of an effective tracking system for problem management and emphasizes the benefits of using tasks over email or other communication tools. The article provides a structured approach to creating tasks and highlights the significance of transparency, accountability, and measurement in this process.

Redefining Healing: How Technology and Personal Touch Are Shaping the Future of Chiropractic Care

A Modern Approach to Chiropractic Care In the rapidly evolving world of healthcare, chiropractic care is not far behind in embracing the winds of change. Integrating technological innovations, automation, and prioritizing patient experience are more than buzzwords; they are shaping the future of chiropractic practice. This transition is not just confined to large healthcare providers; even smaller clinics are adopting these revolutionary methods. From artificial intelligence to personalized patient interactions, the entire landscape of chiropractic care is shifting. Traditional methods are making way for more efficient, patient-centric, and delightful experiences. This article delves into these transformative concepts and explores how they are revolutionizing chiropractic care, aligning it with the needs of modern society. Conversational Booking and AI: Beyond Traditional Scheduling The era of scheduling appointments through tedious phone calls and manual entries is fading. Modern chiropractic practices are turning to AI-powered conversational booking systems that enable patients to schedule their visits seamlessly. Real-time availability pulled from practitioners’ schedules, immediate confirmations, and efficient coordination are the new norms. Patients appreciate the convenience and speed of this approach, often leaving them impressed even before their first visit. For practitioners, this technology not only frees up administrative time but sets the stage for an ongoing relationship that prioritizes individual needs. As a result, the first impression is no longer made in the waiting room; it starts with a smooth and personable booking experience that signals professionalism and care. The Rise of Automation: A Competitive Edge Automation has transcended beyond a mere trend to become a vital part of modern chiropractic care. Implementing automation is not about replacing human touch but enhancing it by removing repetitive tasks. Automation can provide unique and competitive services, offering efficiencies that allow practitioners to focus more on patient care. Clinics that quickly adapt to automation are positioning themselves as industry leaders, differentiating their services in a crowded market. But this advantage may be short-lived as automation becomes the industry standard. Those who act fast will find themselves at the forefront, while late adopters may struggle to keep pace. Integrating automation is more than a strategic move; it’s an imperative adaptation to the technological age. Customer Experience: The Art of Surprise and Delight Chiropractic care has traditionally focused on treatment and recovery, but modern practices understand that the patient experience goes far beyond that. Small shifts in customer service, such as offering a warm greeting, a refreshment, or personal attention, can lead to significant improvements in patient satisfaction. This philosophy of surprising and delighting patients is not new; it has been studied across various industries and adapted to healthcare with great success. By creating a culture of kindness, attention, and connection, clinics are building deeper relationships with their patients. These positive interactions, whether through thoughtful gestures or attentive listening, become stories that patients share, creating a positive reputation in the community. Personal Connection Through Technology: Beyond Text Messages Chiropractors are now leveraging technology to foster personal connections with their patients. Sending a video or selfie from the doctor to a first-time patient is not just a novel idea; it’s a symbol of modern, connected healthcare. It signals that the care provider is accessible, friendly, and engaged, setting the tone for the patient’s experience. This approach reflects a broader shift in healthcare towards patient-centered care that extends beyond clinical interactions. It’s about building trust and connection through technology while retaining the human touch. This blend of technology and personalized interaction elevates the patient experience and offers a fresh perspective on what chiropractic care can be. Collaboration and Community Engagement: A Win-Win Situation Collaboration and community engagement are at the heart of sustainable chiropractic practices. By building partnerships with industry leaders, engaging with community stakeholders, and aligning with local needs, chiropractors can expand their reach and impact. This collaborative approach fosters knowledge sharing, joint initiatives, and community well-being. Active participation in community events, health fairs, and educational seminars enables chiropractors to connect with potential patients and other healthcare providers. It’s not just about marketing; it’s about contributing to the overall wellness of the community. This symbiotic relationship between chiropractors and their community enriches both, building trust, and strengthening connections. A New Era for Chiropractic Care The chiropractic field is entering a new era, one that combines the wisdom of traditional practice with the efficiencies and personal touches made possible by modern technology. The integration of AI-powered conversational booking, the rise of automation, a renewed focus on customer delight, and the spirit of collaboration is paving the way for an industry that’s ready for the future. This transformation underscores a fundamental evolution in chiropractic care, moving from a purely clinical focus to an approach that prioritizes innovation, connection, and the holistic well-being of its patients. It is a model that resonates with the values of modern society and positions chiropractic care as a dynamic and essential part of the healthcare ecosystem.