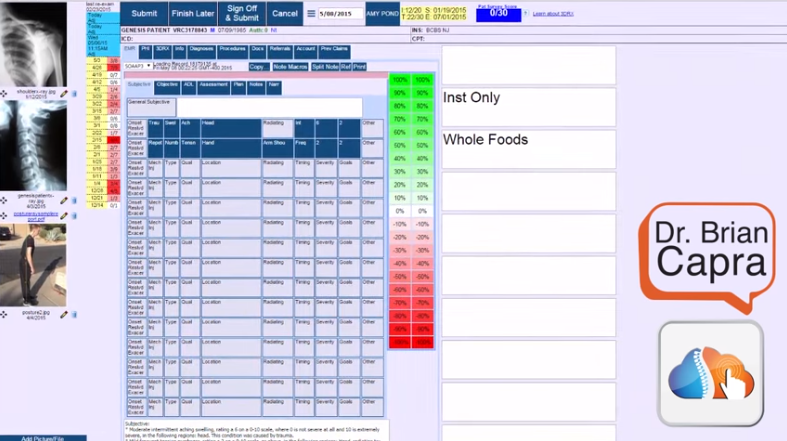

Improvements to the Genesis SOAP note coding

Dr. Brian Capra quickly demonstrates an improvement to the Genesis SOAP notes coding feature. If you click the new button with an arrow on it, then you can copy the diagnosis codes and the procedure codes from your chiropractic documentation SOAP note to the billing claim.

Overcoming Workflow Bottlenecks

Traffic Jams Can running the right reports improve workflow bottlenecks in Dr. Ben’s practice? “Mrs. Wilson!” Pam said, looking up as Carmen came through the door. “Did I hear you talking about me?” Carmen asked her husband playfully. “I was hoping you could come to lunch with me.” “Dr. Ben was talking about our workflow bottlenecks,” Pam put in. “Workflow matters,” Carmen said. “And I think you also should be talking about scalability. Naturally you pay full attention to one patient at a time, but for the sake of the practice you have to be able to look at the big picture and identify the bottlenecks in your workflow.” Pam was silent. “We’re speechless,” Ben said. “I’m glad to see you, of course, but I have no idea what you’re talking about right now.” Pam darted a glance at the patients around them and welcomed a new patient. “Should we be discussing these things in front of them?” she asked quietly when she was free again. “It’s business,” Carmen shrugged. “Your practice is growing because you give your patients excellent care. So you want to continue doing that. How could they object?” She stepped behind the desk and looked over Pam’s shoulder. “For example, can you run a report that shows all the tasks that are coming up tomorrow and who is assigned to do them, and what tasks are still left from today?” “Honey, I don’t think you should be–” Ben began, but Pam stopped him. “I’ll just pull up the list of reports I can run,” she offered. “There’s no sensitive information there.” “There sure are a lot of reports!” Carmen said, her eyes widening. “New Patients, No Shows, No Future Appointments–” “There are lots of patient reports,” Pam agreed, scrolling down the page, “and then we also have things like Inventory, Billing, Patient Balances, Third Party Vendors…” Ben joined them in staring at the screen. “Is that going to help us identify bottlenecks in our workflow?” “I only run a few of them,” Pam admitted. “Mostly, I don’t really know how to set them up the way I want or how to use them once I run them. I think they’re open to interpretation, too, because sometimes they make me think we should do something but the partners don’t agree — sorry, Dr. Ben!” “That’s okay,” he said. “I know what you mean. Often we partners don’t agree with each other, either. It’s like we’re all looking at different information.” “Reports like these are for analysts,” Carmen said firmly, “not for doctors and nurses. You can’t expect to look at a couple hundred lines of a Tasks and Events report and see what you need to do next.” “Plus,” Pam added, “it’s hard for me even to figure out which report to look at. If we’re talking about how smoothly the work goes, I know that a lot of the tasks we do involve multiple aspects of the practice, not just one of the things listed on those pre-made reports.” Ben took his wife’s arm. “We’ll get out of your way now, Pam,” he said, “but thank you for your help.” “How much time do you spend on those reports?” Carmen asked her husband as they walked. “Hardly any,” Ben shrugged. “As Pam said, I don’t really understand how to use them. Plus, I don’t exactly have lots of free time — and I’d rather have lunch with you.” Can running the right reports improve workflow bottlenecks in Dr. Ben’s practice? Disclaimer: For HIPAA compliance, all characters appearing in this post are fictitious. Any resemblance to actual persons or actual events is purely coincidental.

Improving Practice Workflow and Accountability

How can Dr. Ben improve workflow and accountability in his chiropractic practice? Ben smiled reassuringly at his patient, snapped the file closed, and headed to the office. “I think I might need a translator for this patient,” he said. “Of course, Dr. Ben,” Pam assured him, picking up her phone. Ben headed back down the hall with long strides, but when he had finished with the patient, he returned to talk with his office manager. “So, Pam,” he began — and then stopped while she answered a phone call and handed a clipboard of forms to a new patient. “Sorry about that,” Pam smiled. “What can I do for you?” Ben lowered his voice. “Would you say things are going smoothly in the office? I noticed that you were able to provide a translator immediately and it looks as though you have everything under control.” “I pride myself on looking like I have everything under control,” Pam assured him. “And mostly I do, even if sometimes I’m like a duck.” “A duck?” “Gliding along the water on top and paddling like crazy underneath,” Pam laughed. “Seriously, I think things are going pretty well. We have issues. What chiropractic practice doesn’t? But overall it’s good.” “What issues do you see?” Ben pursued the question. “Sometimes we have to search pretty hard to find the information we want,” Pam said promptly. “I’m still waiting for that new software we’ve been talking about.” Ben nodded. “I just haven’t gotten around to it.” “And it would help a lot if staff could really know what their daily workload was going to be. Everyone just comes in and waits for me to tell them what to do. If I don’t have time to tell them anything, they don’t do anything.” Pam’s eyes widened. “I think they’d rather be able to take ownership of their work and get the satisfaction of accomplishing things and being part of the team instead of just hanging around in case they’re needed, but the work just isn’t set up that way.” “The work just doesn’t happen that way,” Ben said. Pam’s face alerted him that he had raised his voice and he lowered it again. “Like the translator — we don’t know ahead of time when we’re going to need him.” Pam looked doubtful. “I’m not so sure that’s true. I mean, it’s not like Mrs. Vargas suddenly didn’t understand. Maybe we should have a note in her file. Maybe we should ask people when we make the appointment. Maybe we could even cluster the appointments of people who might need a particular translator.” Ben frowned. “I feel like we’re getting off track here. Isn’t this just one little thing?” “Yes,” Pam agreed, “but every day is made up of those little things. We do some stop gap thing to solve a problem and after a while it becomes what we do. It’s hard to hold people accountable when they never know what they’ll be accountable for.” “I see your point,” Ben said. “It’s like what my wife calls ‘workflow.’ You’re telling me the work isn’t exactly flowing.” Pam smiled. “I’m not sure that’s what workflow means, exactly, but yes, I guess that’s another way of saying we’re just paddling like crazy under the water.” Disclaimer: For HIPAA compliance, all characters appearing in this post are fictitious. Any resemblance to actual persons or actual events is purely coincidental.

Do You Know Your Practice Management Metrics

Too Many Variables How can Dr. Ben effectively put his information and ideas into his chiropractic practice? Ben closed his office door gently and pulled his chair up to the desk. He pulled his wife’s crayon-made chart from his pocket and smoothed it out on the desktop. Carmen knew a lot about business, he thought. He had to admit that he found that part of his job challenging, but he was also confident that he’d be able to take control of this aspect of the practice now that he had some direction. With medical information, he could look at a few pieces of data and see what was going on — or what else he needed to know to find the answers to his questions. If he needed additional information, he knew where to look for it. And generally speaking, the patients’ charts had the data he needed in the places where he expected it to be. His own experience with that data made it instantly meaningful. It didn’t seem to work that way with practice management. So Carmen had grabbed one of their son’s crayons and drawn him a chart. Ben chuckled. Ben copied the chart into a spreadsheet and hit “print.” He heard “Dr. Ben?” at his door and just had time to put away the original chart before Pam entered. “Dr. Ben, we have another last-minute cancellation.” Pam handed Ben the patient folder. “She’s done this before, hasn’t she?” he asked, checking the file. “She does it pretty regularly,” Pam admitted. “She always says something about work, but I wonder whether maybe she just finds herself short before the appointment comes up, and makes excuses so she won’t have to pay.” “Do we have other patients who work at the same place she does? Do we have the same kinds of problems with them?” “That’s a good question. I’ll check on that. I hate to have to charge her if it’s work-related and she can’t help it.” “If we take that position, though,” Ben pointed out, “we’d never charge anybody for cancelling, even though we have a sign out there explaining the policy. Everybody probably has a reason they think is important.” “I know, but if the cancellations are caused by financial problems, then charging…” Pam continued, but Ben had stopped listening. “This is paralysis by analysis,” he interrupted. “What?” “I mean, we’re looking at so many possibilities and so many hypotheticals that we’re never going to be able to make a firm decision. If cancellations are enough of a problem to us that we have a policy, we ought to follow that policy. She could go to her boss and explain that she’ll lose that $35 fee if she cancels, and then it would be in the boss’s court. Or if it’s financial, she could level with us and we could work out a payment plan for her. All those things about her life are just muddying up the waters for us.” Pam nodded. “You’re right.” “Or if our data shows that cancellations don’t really make any difference to the bottom line, then we could get rid of that policy. But let’s narrow this in to the most basic information we need for the decisions, instead of broadening it out to include all the possibilities we can imagine.” Pam left looking satisfied, but Ben remained in the office, lost in thought. It sounded good when he said that, but the truth was, he didn’t know what no-shows cost him and whether they needed to be firm or not. He didn’t even know how often this particular patient had made a last-minute cancellation or not shown up for an appointment, and Pam simply had a feeling about it, not hard facts. This was definitely a case in which having fast access to the KPIs would improve decision-making at his chiropractic practice. In fact, if he or Pam could spend a little time sorting these things out, they would probably make it up by having fewer conversations agonizing over decisions of that kind and second-guessing their earlier decisions. Ben looked at his spreadsheet. Why couldn’t someone from the office staff pencil in the current figures every week and calculate a running total? Then when questions arose, they could take a quick look at the spreadsheet and find exactly the information they needed. Pam wouldn’t like it, he was sure, but it seemed like just the right solution. How can Dr. Ben effectively put his information and ideas into his chiropractic practice? Disclaimer: For HIPAA compliance, all characters appearing in this post are fictitious. Any resemblance to actual persons or actual events is purely coincidental.

Chiropractic Software | Improve your practice performance by choosing a singular focal point

Can you prioritize the many daily tasks at your chiropractic clinic without feeling anxiety and puzzlement? Getting a singular focal point for you and your staff is necessary for building your dream practice with the right chiropractic software. This focal point basically serves as road map to success while increasing accountability and transparency. It also fosters teamwork and cooperation, which in turn increases predictable profitability growth and control. In order to build your dream practice, you have to set clear goals and balance Key Performance Indicators (KPI) such as Charges, Collections, Visits, No Shows, No Future Appointments and percentage of A/R over 120 days. All the while you have to stay compliant with your chiropractic SOAP notes. But without measuring your practice performance and tracking how each staff members contributes to the chosen goals you will never achieve your dream. In order to solve any practice performance problems that block your path to long-term profitability you need to be able to see the big picture at a glance and look up the necessary, detailed practice stats. Improving your practice performance requires diligent measuring and tracking of each chosen KPI. Only when you know how your practice is doing today, a reliable prediction of how it will perform tomorrow is possible. And by removing the factor of unpredictability from your practice performance you can gain much needed peace of mind. Of course, you don’t have time to search for and analyze multiple reports, let alone track your practice stats. Moreover, this kind of information overload can prevent you from being decisive about allocating resources. The only way to manage your practice effectively is to choose and balance the right KPI so that you can make progress in the selected areas and shift your focus as needed. At the same time this allows you to keep an eye on your overall practice performance. But without the right tools this approach is merely wishful thinking. Genesis Chiropractic Software, however, makes it a reality by providing you with a Radar to track KPI as well as automatically generated, detailed reports on all areas of practice performance, such as chiropractic billing. When you first log on to the home page of your Genesis Chiropractic Software, you can get a quick overview of your practice performance simply by looking at the Radar. It displays selected, vital stats on a single chart across two time points so that you can quickly see where you are right now and discover any trends before they turn into huge problems. You can also drill down into a particular KPI for a comprehensive sense of practice performance. If you want to get to the root of a performance problem you can look up any stats down to the lowest claim aspect and action taken for the appropriate KPI in a detailed, interactive report. For example, you might notice that your chiropractic billing stats are off and discover that the amount for ‘Insurance Collected’ is much lower than ‘Insurance Billed.’ This might indicate a problem with your chiropractic billing claims cycle. You can then look at the ‘Claim Status’ report to find out what might be causing any issues and fix the problem. You can access your practice Radar on your Genesis Chiropractic Software home page and click on a specific KPI to open a single graph. To look at any details of a particular area of practice performance, such as chiropractic billing stats, go to ‘Reports’ in the top menu and select the appropriate one from the drop down menu. Drill down into the desired details by specifying the date, provider or location. Genesis chiropractic reports also include: Context Search Department-wide Saved Queries for Repeat Usage Configurable, Sortable, and Drillable Report Layout by Arbitrarily Customizable Criteria Reconciled Error Reporting Within Standard HCFA form Export to Excel Reporting Across Multiple Departments/Sites Contact your Genesis chiropractic software Profitability Manager to configure your practice Radar with the right KPI’s to help you achieve your goals and build your dream practice. Watch Dr. Haas demonstrate the documentation interface.