Claim Denial Management

Partial denials cause the average medical practice to lose as much as 11% of its revenue (Capko, 2009). Payers are known for denying claim payments for legitimate reasons (provider-generated errors) and arbitrary reasons, motivated by the inherent benefits of controlling the float for the maximal time (Stahl). Systematic denial management must address both kinds of errors. Denial management is difficult because of the (intentional) complexity of denial causes, payer variety, and claim volume. Systematic denial management requires measurement, early claim validation, comprehensive monitoring, and customized tracking of the appeals process. According to a survey by the Medical Group Management Association (MGMA), 69% of organizations reported a significant increase in denials, averaging 17%, in 2021 alone. These findings are further supported by additional alarming statistics (Zipple, 2023): In 2021, claim denials surpassed 48 million (Kaiser 2023). On average, nearly 20% of all claims are denied, and shockingly, up to 60% of these denied claims are never resubmitted (Poland and Harihara, 2022) Certain payers exhibit denial rates as high as 80% (Revenue Cycle Intelligence, 2022) However, there is some hope as, on average, approximately 40% of denials can be overturned through appropriate appeals processes (Kaiser 2023). According to a HIMSS Analytics study, here are some key findings on how hospital executives manage claim denials: 44% of hospital executives rely on vendor solutions to manage denials. 31% of executives still handle denials manually, without any specific tool or software. 18% of hospitals have developed their own in-house tools for denial management. 7% of executives are unsure about the method they use for denial management. Among respondents without a vendor-provided solution, 60% plan to purchase one within the next 7-12 months. (Regulsky, 2023) Denial Risk Classification The denial risk is not uniform across all claims. Certain classes of claims run significantly higher denial risks, depending on six factors: Claim complexity Modifiers, e.g., incorrect modifier used Multiple line items Temporary constraints Claim not filed on time Patient constraints, e.g., claim submission during global periods (see below) Payer constraint (e.g., claim submission timing proximity to the start of the fiscal year) Procedure constraint (e.g., experimental services) Payer idiosyncrasies Bundled services, e.g., services incorrectly bundled or Unbundling and upcoding Disputed medical necessity, e.g., Not a medical necessity Non-covered services Other Patient data Patient deductible Plan benefits exhausted Provider data, e.g., Out-of-network (OON) provider Process Compliance Incorrect insurance ID number Duplicate claim submitted Prior authorization not attached Typo errors in patient information Note that for complex claims, most payers pay the full amount for one line item but then pay only a percentage of the remaining items. This payment approach creates two opportunities for underpayment: The order of paid items The payment percentage of the remaining items Next, temporary constraints often cause payment errors because of the misapplication of constraints. For instance, claims submitted during the global period for services unrelated to the global period are often denied. A global period is a period of time before and after a surgical procedure during which related services are bundled into the initial procedure’s payment. It helps streamline billing by including pre-operative visits, post-operative follow-up care, and related services within a single payment (Master, 2020). Similar mistakes may occur at the start of the fiscal year due to misapplying rules for deductibles or outdated fee schedules. Additionally, payers often vary in their interpretations of Correct Coding Initiative (CCI) bundling rules or coverage of certain services. Developing sensitivity to such idiosyncrasies is a key to full and timely payments. CMS contractors conduct medical reviews on certain claims and prior authorizations to ensure that Medicare payments are made only for services that comply with all Medicare regulations. Suppose a review leads to a denial or non-affirmation decision. In that case, the contractor responsible for the review provides the provider or supplier with a comprehensive explanation detailing the reasons for the denial or non-affirmation. For example, the code AM300 is used when the provided documentation lacks evidence to substantiate the provision of Basic Life Support services during an emergency response. Please refer to 42 CFR § 410.40 (c), 42 CFR § 414.605, Internet Only Manual (IOM), Publication 100-02, Medicare Benefit Policy Manual, Chapter 10, Section 20, and Section 30.1.1 for further clarification and guidelines on this matter. (Reason Statements and Document (EMDR) Codes | CMS). Payers can also separate the Claim Processing and Denial Management departments to add complexity and improve the likelihood of underpayments and delays. In this scenario, the provider may be forced into a deadlock by having to deal with two separate departments for the same claim, where each of the two departments “waits” for the decision of the other. Denial Risk Management Stages In a high-volume clinic, the only practical way to manage denials is to use computer technology and follow a four-step procedure: 1. Prevent mistakes during claim submission This can be accomplished with a built-in claim validation procedure that includes payer-specific tests and EHR integration. Such tests (“pre-submission scrubbing”) compare every claim with Correct Coding Initiative (CCI) regulations, diligently review modifiers used to differentiate between procedures on the same claim, and compare the charged amount with the allowed amount, according to previous experience or the previous contract, to avoid undercharging. Integrating EHR and claims management systems allows for the seamless transfer of patient data and encounter information from the EHR to the claims system. This eliminates the need for manual data entry or transcription, reducing the chances of errors or omissions that may occur during the claims submission process. EHR systems often include built-in templates and structured documentation features that guide providers to capture complete and accurate information. These templates help ensure that all necessary information for claims submission, such as procedure details, diagnoses, and supporting documentation, is appropriately recorded. 2. Identify underpayments Identifying underpayments in the claims process is crucial for healthcare organizations to ensure accurate reimbursement and maximize revenue. This involves comparing the payment with the allowed amount, identifying zero-paid items, and evaluating payment timeliness. The

Change Management – Switching Your Billing Systems

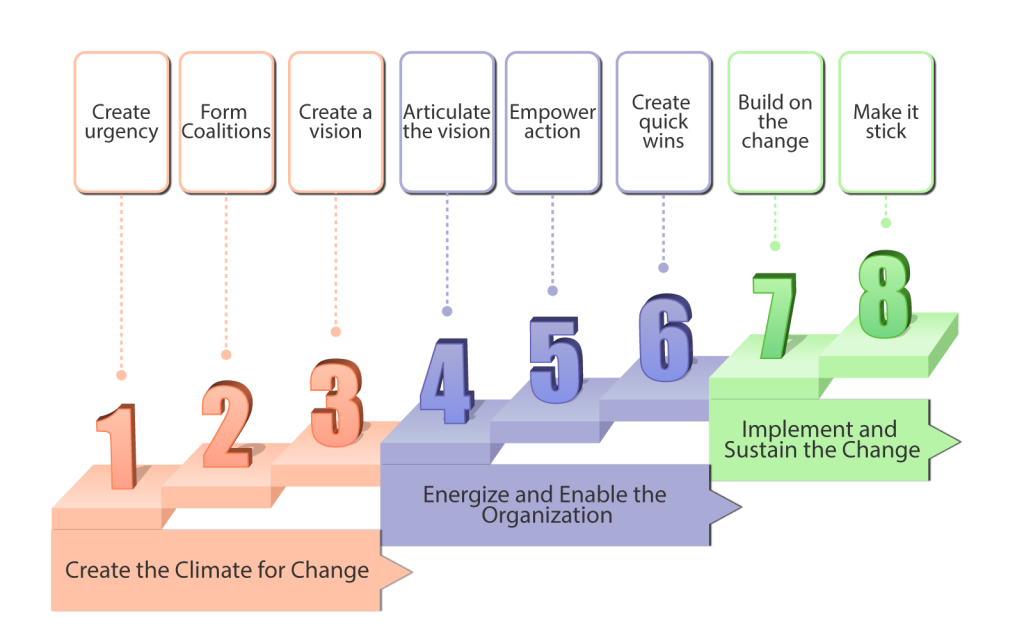

Practice owners seeking better solutions often start with a vision of increased practice profitability while treating reasonable patient volumes. Their vision spans multiple aspects, including better reach to prospective patients, better reimbursement rates, full and timely payments by insurance companies, less time spent on visit documentation, improved documentation quality for better clinical follow-up and lower audit risk, and more free time for family. However, that vision conflicts directly with the payers’ goals to reduce costs and increase revenues. Payers’ goals directly conflict with a provider’s vision because cost savings for payers simply mean that providers treat more patients at lower reimbursement rates—or, in other words, providers work harder for less money. In addition to the basic payer-provider conflict, visionary practice owners must face the resistance of their office managers and colleagues. These people may be skeptical because they don’t trust the owner, have seen five other failed initiatives, or think they might lose something with the change. Significant time, enthusiasm, and resources are needed to change practice processes and technology and to retrain personnel while simultaneously managing the practice and treating patients. The challenge of overcoming resistance to change and implementing it in your practice is akin to enhancing airplane engineering while keeping the plane in the air. Thus, medical practice owners often find themselves in a dilemma between adopting new solutions or compromising the vision and returning to the old ways, along with shrinking revenues and growing frustration. One key area of medical practice that requires a huge transition is shifting from paper-based records to an electronic health record (EHR) system. Shifting from one EHR system to another is also burdensome and requires a systematic approach to achieve results. Several internet-based software and tools can aid medical practices in transitioning to electronic records successfully, leading to maximized outputs and better service delivery to patients. We shall look at how to adopt this change using a change model. EHR and billing processes can help providers cut costs, improve the quality and safety of care, and enhance the productivity of the employees. Most practices have adopted EHR and electronic billing systems to achieve the above goals, whereas some have stuck to using paper documentation and filing systems. Paper-based records are often tiresome to retrieve, prone to errors and misplacements in addition to being bulky and space-consuming to store. Paper-based billing systems have also been shown to take longer claims processing times than EHR due to the time taken to verify manually. To fully realize change and adopt it into practice, a stepwise approach has to be taken, failure to which frustrations and complacencies are bound to occur, leading to regression to previous ways. John Kotter, a Harvard Business School professor and the world’s foremost authority on leadership and change, discovered that transformation challenges span multiple industries and share the same characteristics. His book Leading Change lists an eight-step process for implementing successful transformations. The eight steps can be divided into 3 phases: creating the climate for change, energizing & enabling them, and implementing and sustaining the change (National Learning Consortium, 2013). The figure below illustrates these three phases. Figure 1: The three phases of Kotter’s eight-step change management model This model has successfully been used to help transition into an electronic health records system in clinical practices. For instance, North Shore Medical Center in Chicago, Illinois, successfully transitioned from 100 percent paper-based medical records to 100 percent electronic records in 2013 using Kotter’s eight-step model (Martin and Voynov, 2014). An orthopedic practice group in Ontario, Canada, also successfully transitioned from paper records to electronic records, achieving more than a 95% threshold using Kotter’s change model (Auguste, 2013). We shall look into the eight steps in detail using an example of a healthcare practice that desires to transition from paper-based records to electronic health records and billing. Step 1: Create a sense of urgency. In this step, a health practice can provide evidence to its employees on the need for an EHR. This can include faster claims processing, less bulky storage space, easy records retrieval, and better security. At this stage, the aim is for employees to buy into EHR and keep talking about the proposed change. Step 2: Form a powerful coalition. To help convince employees that change is necessary, the practice can develop a committee of committed and passionate individuals who constantly champion EHR. These individuals can work as a team to help identify barriers to implementation as well as help remind other employees of the need for EHR constantly. Step 3- Create a vision for change. The practice can develop a clear and concise vision through the committee, which motivates transition. An example of a vision would be establishing the most secure health records for clinic patients. Step 4: Communicate the vision for buy-in. Once the vision is created, it must be communicated to the employees clearly explaining the benefits to encourage buy-in. This can be achieved through face-to-face meetings, sending email reminders on the transition from paper to EHR, and individual interviews. Step 5: Remove obstacles. There are 5 categories of barriers hinder any change from occurring in an organization, the biggest of which are complacency and resistance to change (IvyPanda, 2020). The 5 categories include complacency, Limited sharing of the vision, Different obstacles to the vision, Inability to accomplish short-term wins, and failure to solidify the change in the practice culture. Let’s briefly talk about the five categories of barriers. 1. Complacency– This is the most deadly of practice change management problems. Suppose you just plunge ahead with a new electronic medical records (EMR) system or billing process without first establishing a shared sense of immediate need or urgency because of increased audit risk or shrinking revenue. In that case, natural complacency takes over—and the entire change effort fails. It’s hard to drive people out of their comfort zones. Past failures, the lack of a visible crisis, low-performance standards, and insufficient feedback from doctors, office personnel, and patients—all add up to turning the best-intended change initiatives

Factoring

Introduction Factoring can improve cash flow and operational efficiencies, and it is used in many industries, including the healthcare sector. With this strategy, businesses sell their accounts receivable at a discount to a factoring company (the factor), giving them access to quick cash. The burden of recovering the debt from the consumer who has not paid their invoice is transferred to the factoring company. The corporation has access to its earnings immediately, skipping the customary payout period (Ferguson, 2020, Factris, 2021). Popularity of Factoring The worldwide factoring services industry will reach USD 3.5 billion by 2032, growing 8.5% annually. The market’s growth is driven by cash flow management, working capital financing, and SMEs’ use of factoring services (FID Reports and Data, 2023). The U.S. factoring services market will reach USD 287.61 billion by 2030, growing 8.1% from 153.96 billion in 2022 (Grand View Research, 2023). According to a survey, factoring services have grown in popularity, especially among Micro, Small, and Medium-Sized Enterprises (MSMEs) that have trouble securing appropriate financing, particularly in working capital. There are 127 factoring companies in the US and Canada. Mazon Associates in Dallas, Crown Financial in Houston, Provident Commercial Finance in Chattanooga, Bankers Factoring near Atlanta, J D Factors in Los Angeles, and Velocity Financial in Midland are considered to be the top-performing 2023 companies (Factoring Club, 2023). A few other examples include (Treece, 2023): FundThrough offers 100% advance rates on up to $10 million in finance, with costs starting at 2.75%. Riviera Finance offers 95% advances on $5,000–$2 million loans. They are known for their individualized service and face-to-face knowledge. altLINE offers up to 90% advances and can quote lending amounts. They specialize in huge invoices and charge 0.50% APR. TCI Business Capital finance $50,000–$10 million at 60%–90% advance rates. They offer bespoke factoring solutions and don’t disclose their APR. Healthcare providers frequently encounter delays in receiving reimbursements from insurance companies. The quality of healthcare providers’ services may suffer due to delays (Fundbox, 2023). Healthcare providers use factoring firms to speed up the payment procedure. They sell the health insurance claims—basically unpaid invoices—to factoring companies, who recover the claim payments from the insurance providers. By ensuring prompt claim payouts, this method aids healthcare providers in maintaining their highest levels of operational effectiveness. On the other hand, some practice owners may disapprove of the factor’s specific approach to managing patient or payer interactions (Factris, 2021). Factoring Process Initially, healthcare vendors or medical providers send invoices (claims) to either a medical provider or third-party payer (Medicaid, Medicare, private insurance companies) for services rendered or goods provided. Following this, a copy of the invoices, along with any supporting documentation, is submitted to a factoring company like PRN Funding, LLC (PRN Funding, 2020). Subsequently, the factoring company purchases these invoices and advances 80-90% of their face value, with funds typically deposited directly into the vendor’s or provider’s bank account within 24-72 hours. The remaining percentage is used as a buffer in case some bills do not get paid or if there are billing errors. Eventually, the reserve, less the factoring fee, is released back to the vendor or provider after receiving payments (PRN Funding, 2020). Step-by-Step: Healthcare vendors or medical providers send medical claims to medical providers or third-party payers (such as Medicaid, Medicare, or private insurance companies). A factoring business (the factor) Receives copies of the invoices and any necessary supporting documentation. Purchases these invoices at a discount, typically around 80-90% of their face value. Advances the funds directly into the vendor’s or provider’s bank account within 24-72 hours. Holds a portion of the invoice amount as a reserve in case some bills go unpaid or there are billing errors. Assumes the responsibility of collecting outstanding payments from insurance providers, relieving the healthcare provider from the burden of debt collection. Collects the payments received from insurance companies or third-party payers. Releases the reserve, minus the factoring fee, back to the vendor or provider once the payments are received. How does the factor estimate the quality of the outstanding claims? The factor assesses the quality of outstanding claims through various methods and criteria. This assessment helps determine the likelihood of prompt payment, helps minimize non-payment risk, and ensures that the factor can provide immediate capital to healthcare providers while maintaining a reasonable level of risk. Here’s how the factor determines the quality of the outstanding claims: Evaluation of the payer: The factor examines the insurance companies or third-party payers responsible for reimbursing the claims. They consider the payer’s reputation, track record of timely payments, financial stability, credit scores, and payment history. Specific policies, guidelines, and requirements for claim processing. These include claim submission deadlines, pre-authorization requirements, and claim acceptance rates. Collaboration with healthcare providers: Factors collaborate closely with healthcare providers to gather information about outstanding claims. Providers may share their experiences with different payers, providing valuable insights into the quality and reliability of the claims. Verification of claim documentation: The factor reviews the supporting documentation accompanying the outstanding claims. This includes verifying the accuracy and completeness of the medical records, coding, and billing information. Thorough documentation ensures that the claims are valid and are more likely to be paid. Analysis of historical data: The factor analyzes the provider’s historical payment patterns from different insurance companies or payers. This analysis helps identify any trends or patterns of delayed payments or denials, providing insights into the quality and reliability of the outstanding claims. Industry Knowledge and Expertise: Factors with experience in the healthcare industry develop expertise and knowledge about various payers, their reimbursement practices, and the industry’s dynamics. They stay updated with industry news, regulatory changes, and trends that may affect payment processes. This industry knowledge enables them to predict payment delays and amounts. Strategies for Choosing the Best Factor for Your Practice The factor selection decision depends on the factor’s stability and track record, the factoring service fees (2%-3.5% monthly was typical in 2022), the terms of the factoring agreement, the type

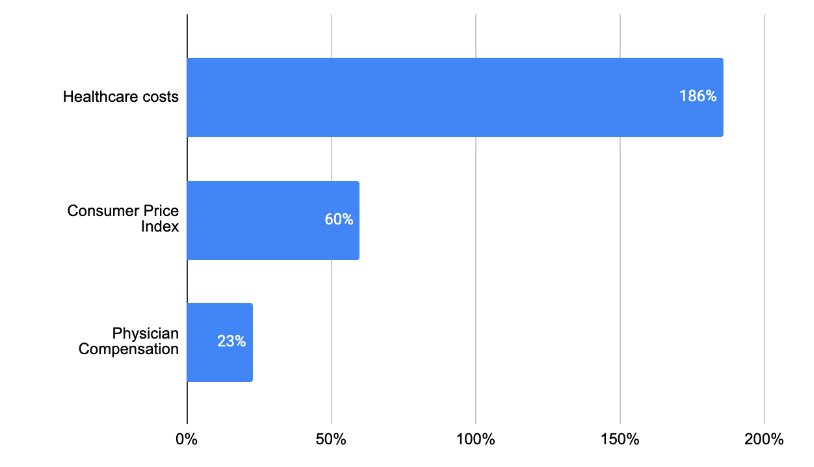

Has the Provider’s Compensation Kept Up With the Economy or Healthcare Costs?

The U.S. faces escalating healthcare spending, with 2021 per capita costs reaching $12,318. Compared to advanced economies, the U.S. spent double the amount on healthcare. Factors contributing to this include an aging population, expensive medical innovations, and defensive medicine practices. Chronic diseases among older adults are a significant cost driver. Rising healthcare expenditures and declining physician income create a paradox in the industry. The excessive cost of medical innovation, demographic shifts, and defensive medical practices challenge healthcare affordability and sustainability.

Navigating Insurance Audits and Compliance

Health insurance audits can be daunting for private practices. Auditors aim to ensure correct billing and proper claims handling. Audits can be routine or event-triggered, conducted by payors, either commercial insurance providers or government entities. Preparation and education are key to surviving audits. Providers should maintain compliant documentation, understand the audit process, and use practice management platforms like ClinicMind to streamline recordkeeping and compliance, making audits less intimidating.

Using Analytics to Optimize Insurance Management

Analytics play a crucial role in optimizing insurance management for private practices and healthcare providers. Monitoring approvals, denials, and appeals provides valuable insights. Identifying the specific reasons behind denials, like coding errors or insufficient documentation, helps address underlying issues. Analytics offer quantifiable insights to streamline operations, reduce inconsistencies, and adapt to evolving circumstances. ClinicMind’s EHR/RCM platform offers comprehensive reporting and analytics features to enhance insurance management, improving practice efficiency.

Battling Insurance Claim Turbulence

The insurance industry relies on shared risk and managing the financial float is crucial for profitability. Insurance companies invest premiums to maximize returns while maintaining the float’s value. Service providers, like hospitals and private practices, face challenges in filing claims correctly to avoid errors and delays in payments. Implementing advanced software, like ClinicMind, helps streamline practice management, reduce administrative burdens, and ensure accurate claims processing, leveling the playing field between payers and providers.

Facing Insurance Claim Adversity

Payor-provider adversity in the healthcare industry results from opposing interests between insurance payors (companies) and healthcare providers (clinics). Payors aim to minimize claims payouts and delay payments, while providers rely on timely claims processing. Technological solutions like ClinicMind help level the playing field, reducing errors in claims processing. ClinicMind streamlines administrative tasks, leading to better efficiency and revenue management for healthcare practices.

Can Chiropractic Care Be Covered by Insurance?

What happens when a patient shows you their car insurance card to pay for your services? More often than not, this is one of the accepted forms of insurance to pay for chiropractic care services. About 87% of private insurance companies include chiropractic care as part of their medical coverage included in automotive policy. But here’s what to look out for when something isn’t covered. Typically, maintenance and wellness treatment plans aren’t covered by car insurance. It’s still worth double-checking as this isn’t always the case for every automotive policy. In addition to car insurance, U.S. military are eligible to use their government insurance for chiropractic care at over 120 federal bases and medical facilities. Some of the most common insurance providers that cover chiropractic care include: Aetna AVmed Blue Cross Blue Shield Cigna Humana UnitedHealthCare Most insurance policies will cover 50% to 100% of your care plans, so you can expect insurance companies to be the primary source of incoming revenue. You may also find some patients without insurance who are willing to pay up to $200 per visit depending on the service and type of treatment needed. Here are other factors insurance companies look at when providing coverage for services: Clinic location Tests and services Type of technology In the event you’re working with underinsured or patients without insurance, you may want to discuss potential finance or payment plans with them

Finding Solutions to Insurance Claim Problems

Payor adversity in healthcare refers to payment disputes, delays, and billing challenges with various payors, impacting providers’ revenue and workflow. Electronic Health Records (EHR) and practice management software, like ClinicMind, offer solutions to streamline payment processes, manage billing efficiently, and track payments. ClinicMind provides customizable EHR and practice management tools with comprehensive training and support for healthcare providers.