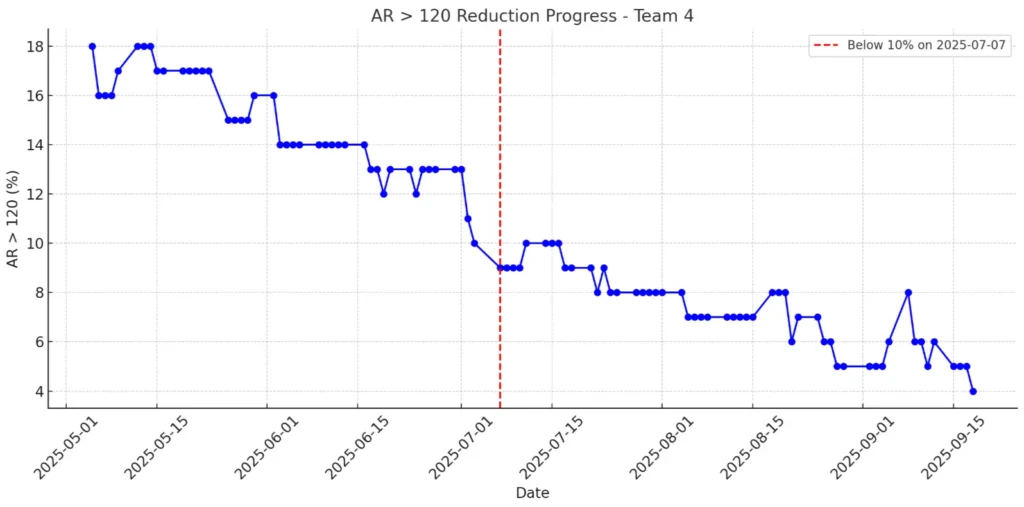

How ClinicMind’s RCM Software + Service Reduced A/R Over 120 to 4%

How ClinicMind’s RCM Software + Service Reduced A/R Over 120 to 4% In healthcare revenue cycle management (RCM), results are what count. Achieving numbers like these is rare. ClinicMind’s RCM Team recently reached an A/R over 120 days of just 4%, which is only a third of the industry average of 13.4% according to MGMA. This milestone didn’t happen by chance. It came from ClinicMind’s approach of blending strong RCM software with skilled human support. This system helps practices lower their aged A/R and speed up cash flow. What is A/R > 120, and Why Does It Matter? Accounts Receivable (A/R) aged beyond 120 days represents money practices may never collect. The higher the percentage, the greater the financial strain. With the industry benchmark sitting at 13.4%, many practices face delayed or lost revenue. ClinicMind’s Team kept their rate at just 4%, showing that practices can reach and maintain top results when they have the right tools and expertise. From 13% to 4%: ClinicMind’s 60-Day A/R Reduction Journey Late June 2025 Team was at 13%, aligned with MGMA benchmarks. In July 2025, our numbers improved steadily, moving from 12% to 9%, then 7%, and finally 6%. By August 2025, we held steady between 5% and 7%, finishing the month at 4%. Within 60 days, we cut our aged A/R in half and kept it at that level. ClinicMind RCM Software: Automating Revenue Cycle Management Our software helps you work more accurately, saves time with automation, and keeps everything clear. Daily RCM Dashboards: The 4% metric itself came from real time ClinicMind dashboards, providing transparency for clients and teams alike. Automated Denial Alerts: Same-day appeal workflows were triggered instantly by software, preventing delays. Bulk Patient Statements: Automated statement generation and small balance sweeps ensured no revenue was overlooked. Account Prioritization: Smart filters highlighted high-balance accounts, allowing teams to focus on the most critical accounts first. Expert RCM Services that Deliver Results Same-Day Appeals: Analysts acted immediately on flagged denials. Collector Focus: Experienced team members handled the top 20 high-balance accounts directly. Backlog Blitz: Analysts were temporarily reassigned to address the A/R over 120-day backlog. They worked at scale based on insights from the dashboards. The Result: Software created visibility and automation; the service team applied judgment, persistence, and expertise. This balance of technology and expert support is what makes ClinicMind a leader in healthcare revenue cycle management and RCM billing services. Why ClinicMind’s A/R Performance Matters for Practices Benchmark Beating: 4% vs. 13.4% shows ClinicMind delivers world-class outcomes. Consistency: This was not just a brief improvement. The ongoing performance trend shows that these results are sustainable. Scalability: The same playbook of software + service can be replicated across other teams and client BPOs. By combining RCM software with expert human support, ClinicMind helps practices achieve world-class revenue cycle optimization Software + Service = Sustainable RCM Success Technology by itself can’t fix revenue cycle challenges, and service alone won’t scale without the right data and automation. ClinicMind’s story shows that when smart software and expert service work together, the financial results are hard to beat. See how your practice can achieve industry-leading A/R results with the right technology and expert support – Book a consultation to learn more

The Compound Effect of Simultaneous Growth in Patient Attraction, Average Patient Value, and Billing Performance Quality

In the world of healthcare practices, sustainable growth requires more than just delivering excellent care—it demands a strategic approach to increasing revenue and operational efficiency. To achieve consistent and scalable growth, practices can focus on improving three critical areas simultaneously: patient attraction, average patient value (APV), and billing performance quality. The synergistic effect of advancing these pillars creates a compounding impact that accelerates the practice’s success. 1. Patient Attraction: The Gateway to Growth Patient attraction is the foundation of a thriving healthcare practice. Without a steady influx of new patients, growth stagnates, and opportunities for increasing revenue diminish. Strategies for Improving Patient Attraction: Digital Presence: Build a robust online presence through a well-designed website, active social media engagement, and local search optimization. Reputation Management: Encourage satisfied patients to leave reviews and testimonials. Positive reviews build trust and attract new patients. Community Outreach: Partner with local businesses, schools, or organizations to raise awareness of your services. Specialized Services: Offer niche or advanced procedures that differentiate your practice from competitors. The more effectively you attract patients, the larger your pool for implementing improvements in the other two areas—APV and billing performance. 2. Average Patient Value: Maximizing the Patient Relationship Once patients are in the door, the focus shifts to increasing their lifetime value to the practice. APV measures the revenue each patient generates over time. By optimizing APV, practices ensure they’re making the most of every patient interaction. Strategies for Enhancing APV: Upselling and Cross-Selling: Educate patients about complementary or advanced treatment options that enhance their care experience and outcomes. Membership Programs: Offer subscription-based plans for routine services to encourage patient loyalty and consistent revenue streams. Continuity of Care: Implement systems to schedule follow-up visits, ensuring ongoing patient engagement and treatment adherence. Patient Education: Empower patients with knowledge about their conditions and available treatments, fostering trust and encouraging higher-value care decisions. Increasing APV not only boosts revenue but also strengthens patient relationships, creating ambassadors who promote your practice organically. 3. Billing Performance Quality: Ensuring Financial Efficiency Revenue cycle management (RCM) is often overlooked as a growth driver, but effective billing practices ensure that every dollar earned is collected promptly and accurately. Billing performance quality directly impacts cash flow and profitability. Strategies for Improving Billing Performance: Automation Tools: Invest in software that streamlines billing, reduces errors, and accelerates claim submissions. Training and Development: Regularly train staff on coding updates, insurance guidelines, and patient communication. Transparent Pricing: Offer clear, upfront pricing to minimize patient confusion and improve collections. Data Analysis: Monitor key performance indicators (KPIs) like denial rates, days in accounts receivable (AR), and collection rates to identify and address inefficiencies. A well-oiled billing system allows practices to reinvest resources into patient attraction and care enhancements, fueling further growth. The Compound Effect: How These Pillars Amplify Each Other When practices focus on all three areas simultaneously, the growth potential multiplies. Here’s how the compounding effect works: Enhanced Patient Experience: Improved APV strategies often include better communication, education, and follow-up care, which naturally attract more patients through word-of-mouth referrals. Increased Operational Capacity: Efficient billing improves cash flow, enabling investments in marketing and patient-centric technologies that further boost attraction and APV. Scalable Growth: A higher APV means more revenue per patient, reducing the pressure to attract massive numbers of new patients to achieve financial goals. By aligning efforts in these areas, practices create a self-reinforcing growth loop. New patients bring in revenue, efficient billing optimizes cash flow, and higher APV ensures each patient contributes more to the practice’s success. Final Thoughts: A Blueprint for Sustainable Growth To create compounding growth, practices must take a strategic, data-driven approach. Start by assessing your current performance in patient attraction, APV, and billing. Identify opportunities for improvement, set measurable goals, and invest in tools and training to support your team. When these pillars work together, the results are transformative. Not only will your practice grow, but it will also create a sustainable, patient-centric business model that thrives in any healthcare environment. By committing to continuous improvement, you can unlock the full potential of your practice and achieve lasting success.

Make Payments a Competitive Advantage for Your Practice

In the fast-evolving world of healthcare, efficiency is critical. From patient care to administrative tasks, every second counts. One area where practices often struggle is managing patient payments. Multiple systems, manual entry, and clunky payment processes create unnecessary bottlenecks for practices and headaches for patients. So, how can healthcare providers overcome these challenges? Introducing ClinicMindPay, our newly launched integrated payment processing solution that seamlessly integrates with ClinicMind’s EHR and practice management system. Designed to simplify the payment experience for both patients and practices, ClinicMindPay offers the flexibility, security, and convenience that healthcare practices need to thrive in today’s competitive landscape. Why Should Practices Use ClinicMindPay? If you manage a healthcare practice, you’re likely familiar with the challenges surrounding payment processing. Whether it’s dealing with delayed payments, reconciling invoices manually, or navigating multiple platforms, these inefficiencies add unnecessary complexity to your day-to-day operations. Payment management is often a time-consuming process that can take your focus away from patient care. That’s where ClinicMindPay comes in. Powered by Fortis’ proven technology, ClinicMindPay not only streamlines payments but also fully integrates with ClinicMind’s suite of solutions. Imagine never having to worry about missing payments or spending hours entering data. With ClinicMindPay, your payments sync effortlessly, giving you time back to focus on what matters most—your patients. How ClinicMindPay Solves Payment Challenges Complete Integration: One of the standout features of ClinicMindPay is its seamless integration into your existing ClinicMind EHR and practice management system. Payments are automatically recorded and tracked, reducing administrative workload and minimizing errors. Patient Convenience: In today’s digital world, patients expect convenience. ClinicMindPay allows your patients to pay using their preferred method—whether it’s a credit card, ACH, or even digital wallets—making it easier for them to settle their bills quickly and efficiently. Secure and Reliable: Security is paramount in healthcare, and ClinicMindPay is built with that in mind. Our platform offers top-notch security features to ensure that all transactions are processed safely, providing peace of mind for both you and your patients. Streamlined Reporting: With comprehensive reporting tools, ClinicMindPay makes it easy to track payments, generate reports, and gain insights into your revenue cycle. The result? A more organized, efficient, and financially healthy practice. The Transition for Fortis Clients For our valued Fortis users, the transition to ClinicMindPay is effortless. You won’t need to do anything—your account will be automatically migrated to ClinicMindPay, and you’ll continue to enjoy the same reliable payment services, now with deeper integration into ClinicMind’s suite of solutions. Why Choose ClinicMindPay? ClinicMindPay reflects our dedication to delivering a seamless, all-in-one solution for managing payments. More than just a payment platform, it’s an integrated tool crafted to streamline your operations, enhance patient satisfaction, and boost overall efficiency in your practice. If you’re ready to simplify your payment processes and enhance your practice’s financial health, ClinicMindPay is the solution you’ve been waiting for. For more information on ClinicMindPay and how it can benefit your practice, visit our ClinicMindPay page. You can also check out our full press release to dive deeper into how ClinicMindPay is transforming payment solutions for healthcare providers. Read the press release here.

Transforming Healthcare Billing: How ClinicMind’s Billing Depot Addresses Current Challenges

In today’s fast-paced healthcare landscape, the need for efficient and secure billing solutions has never been more critical. Recent events, such as the cyberattack on UnitedHealth Group, have highlighted vulnerabilities in the healthcare sector, raising questions about data security and the integrity of billing practices. As healthcare providers navigate these challenges, ClinicMind’s Billing Depot emerges as a vital tool in modern practice management. Understanding the Current Landscape The UnitedHealth Group cyberattack serves as a wake-up call for healthcare organizations, reminding them of the importance of robust cybersecurity measures. With sensitive patient data at risk, healthcare providers must prioritize security without sacrificing efficiency. Billing systems are often prime targets for cybercriminals, making it essential for practices to adopt solutions that not only streamline billing processes but also safeguard sensitive information. Why Choose Billing Depot? ClinicMind’s Billing Depot offers a comprehensive billing management solution tailored to the needs of healthcare providers. Here are several key features that set Billing Depot apart, especially in light of current events: Enhanced Security Protocols: ClinicMind’s Billing Depot employs state-of-the-art security measures to protect patient data. This includes encryption, secure access controls, and regular audits to ensure compliance with industry standards. In a time when cyber threats are prevalent, these features provide peace of mind for both providers and patients. Streamlined Workflow: The software simplifies the billing process, reducing administrative burdens. By automating tasks like claim submissions and payment tracking, ClinicMind’s Billing Depot allows healthcare professionals to focus on patient care rather than paperwork. This efficiency is particularly important as practices adapt to increasing patient loads and changing regulations. Real-Time Analytics: With integrated analytics tools, ClinicMind’s Billing Depot empowers practices to make informed financial decisions. Providers can track revenue cycles, identify trends, and optimize their billing strategies. This data-driven approach is crucial for navigating the financial uncertainties posed by ongoing healthcare challenges. Patient-Centric Approach: ClinicMind’s Billing Depot enhances patient engagement through transparent billing processes. Clear communication regarding charges and payments fosters trust, which is essential in a time when patients are more conscious of healthcare costs. Scalability: As healthcare practices grow or adapt to new challenges, ClinicMind’s Billing Depot scales to meet evolving needs. This flexibility is particularly valuable for organizations responding to shifting regulations and market demands. Staying Ahead of Industry Trends The healthcare industry is continually evolving, influenced by technological advancements and regulatory changes. As practices seek to stay competitive, tools like ClinicMind’s Billing Depot can make a significant difference. By integrating advanced billing solutions, providers can not only enhance operational efficiency but also strengthen their resilience against potential cyber threats. In conclusion, ClinicMind’s Billing Depot is not just a software solution; it’s a partner in navigating the complexities of healthcare billing in a rapidly changing environment. As the industry faces challenges like cyberattacks and financial pressures, embracing innovative technology can lead to improved outcomes for both providers and patients. Ready to transform your practice’s billing process? Discover how ClinicMind’s Billing Depot can enhance your efficiency, security, and patient satisfaction. Book a Demo Now! https://clinicmind.com/billing-depot-billing-practice-management-page/

Important Modern Insights and Research into Pre- and Post-Payment Audits

The relationship between pre-bill and post-bill auditing forms a cohesive integration in the revenue cycle. Pre-bill audits prevent errors, boost efficiencies, and safeguard revenue, while post-payment audits provide retrospective insights into navigating payer disputes with evidence-based knowledge. The following developments in technology and innovation have enhanced the effectiveness and efficiency of audits. By integrating these latest technologies, healthcare organizations can improve fraud detection, enhance accuracy, and improve overall financial integrity. The 6 Most Important Developments in Pre-and Post-Payment Audits Advanced Analytics and Artificial Intelligence The integration of advanced analytics and artificial intelligence (AI) technologies has significantly advanced pre-payment and post-payment audits, enabling more accurate identification of potential billing errors, streamlining the audit process, and enhancing overall effectiveness (Huang et al., 2022). In pre-payment audits, AI algorithms analyze large volumes of claims data, identify patterns, and flag anomalies, helping auditors prioritize high-risk claims for review. The use of predictive modeling and machine learning algorithms improves accuracy in identifying potential discrepancies, reducing the burden on auditors. Similarly, in post-payment audits, the application of data analytics and machine learning techniques revolutionizes fraud detection. Advanced algorithms analyze vast amounts of claim data, identifying patterns, anomalies, and potentially fraudulent activities with greater accuracy and speed. This enables auditors to proactively detect and investigate suspicious claims, leading to improved fraud prevention and financial integrity. Real-time Claims Adjudication Real-time claim adjudication systems play a crucial role in both prepayment and post-payment audits. By leveraging these systems, payers can validate claims against billing guidelines and medical policies in real-time, ensuring accurate and compliant payments (Arnold, 2023). In pre-payment audits, the incorporation of automated rule engines and decision support tools allows payers to proactively identify errors or improper billing practices before claims are paid. Real-time adjudication systems provide instant feedback on claim submissions, enhancing provider education and compliance. This immediate validation of claims against guidelines helps prevent payment errors and ensure payment accuracy. Likewise, in post-payment audits, real-time claim adjudication systems help auditors promptly validate claims, detect inconsistencies, and investigate suspicious activities. By providing instant validation and feedback, these systems contribute to improving audit efficiency and effectiveness. Robotic Process Automation (RPA) Robotic Process Automation (RPA) technology has brought significant advancements to both prepayment and post-payment audits. By automating repetitive and rule-based tasks, RPA streamlines the audit process, reduces processing time, and minimizes human errors (Dhanashree, 2022). In pre-payment audits, software robots deployed in RPA assist in tasks such as data entry, verification, cross-referencing multiple data sources, validating provider information, and conducting eligibility checks. These automation capabilities enhance the efficiency and accuracy of pre-payment audits. Similarly, in post-payment audits, RPA technology assists auditors in data validation and verification processes, improving overall audit efficiency. By automating tasks such as data entry and verification, RPA minimizes manual effort, accelerates the audit process, and reduces the likelihood of errors. Machine Learning for Fraud Detection Machine learning techniques have become invaluable for fraud detection in prepayment and post-payment audits. By analyzing claims data using advanced algorithms, machine learning models can identify patterns, anomalies, and potentially fraudulent activities more accurately and quickly (Stiernstedt & Brooks, 2020). In pre-payment audits, machine learning algorithms analyze large amounts of claim data, enabling auditors to identify high-risk claims requiring further review. By proactively detecting discrepancies and potentially fraudulent activities, auditors can improve fraud prevention and ensure financial integrity in the payment process. Similarly, machine learning techniques in post-payment audits revolutionize fraud detection by analyzing claims data for patterns and potentially fraudulent activities. By leveraging these technologies, auditors can proactively detect and investigate suspicious claims, ultimately enhancing fraud prevention efforts and ensuring financial integrity. Predictive Modeling for Risk Assessment Predictive modeling techniques have emerged as valuable risk assessment tools in prepayment and post-payment audits. By analyzing historical claims data, payer-specific patterns, and industry benchmarks, predictive models can assess the risk associated with certain providers, services, or billing practices (Broby, 2022). In pre-payment audits, predictive modeling helps auditors prioritize their efforts by focusing on high-risk areas and optimizing resource allocation for more effective audits. By utilizing predictive modeling, auditors can identify providers or billing practices with a higher likelihood of errors or irregularities, allowing for targeted investigations and improved audit outcomes. Similarly, in post-payment audits, predictive modeling aids auditors in assessing the risk associated with specific providers, services, or billing practices. By analyzing historical claims data and industry benchmarks, predictive models provide insights into potential areas of concern, enabling auditors to allocate their resources efficiently and focus on high-risk targets. This approach enhances the effectiveness of post-payment audits and increases the likelihood of detecting fraudulent activities or billing discrepancies. Blockchain Technology for Audit Trail Transparency Blockchain technology offers enhanced transparency and integrity in both prepayment and post-payment audits by creating an immutable and auditable trail of claims-related transactions. By leveraging blockchain’s decentralized and tamper-proof nature, auditors gain access to a transparent record of claim submissions, payments, and adjustments (Regueiro et al., 2021). In pre-payment audits, blockchain-enabled audit trails ensure the accuracy and reliability of the payment process. Blockchain records’ transparent and immutable nature simplifies the auditing process and provides verifiable evidence, reducing the chances of errors, fraud, or unauthorized modifications. Likewise, in post-payment audits, blockchain technology strengthens the integrity of the audit trail by creating an unalterable record of claims-related transactions. Auditors can rely on blockchain’s transparency and immutability to verify the accuracy of claims, payments, and adjustments, facilitating more efficient and reliable post-payment audits. In Summary Automated workflows and intelligent algorithms streamline the pre and post payment process, optimizing resources and reducing manual errors. Transparent communication with stakeholders, including providers and insurers, resolves discrepancies efficiently and effectively. Regular monitoring and updates adapt to evolving fraud schemes, effectively combating fraud, waste, and abuse. A well-designed payment scrutiny system ensures accurate identification, minimizes errors, and maximizes recovery opportunities. Billing transparency is a top priority at ClinicMind. We are committed to providing you with easy access to comprehensive reporting. With our intuitive system, you no longer have to jump from portal to portal to find answers. We offer over 50 reports that

Fortis: Chiropractic Payment Solutions

In the intricate world of chiropractic practices, where patient care and business operations intersect, finding seamless and efficient payment solutions is paramount. Fortis, a pioneering player in the field of merchant services, has emerged as a game-changer, offering tailored payment solutions designed specifically for chiropractors. In a recent conversation with Jonathan McAleese, CEO of Fortis, we delved into the roots of their journey, the evolution of their services, and the future of chiropractic payment technology. A Legacy Rooted in Chiropractic Care Jonathan’s journey into the world of chiropractic payment solutions is deeply personal. It traces back to his family’s profound connection to chiropractic care, spanning generations. His father’s transformative experience with chiropractic treatment, amidst the challenges faced during his service in the Marine Corps, laid the foundation for Jonathan’s lifelong commitment to the chiropractic profession. With chiropractors woven into the fabric of his family tree, Jonathan’s upbringing immersed him in the world of chiropractic care from an early age. Genesis: A Pioneering Partnership Fortis’ foray into the chiropractic space was catalyzed by a pivotal partnership with Genesis, a leading provider of chiropractic practice management software. Recognizing the unique needs of chiropractors, Fortis Pay integrated seamlessly with Genesis, offering practitioners a comprehensive suite of payment solutions within their existing workflow. From processing credit card payments to managing recurring billing and beyond, Fortis’ integration with Genesis streamlined practice operations, enhancing efficiency and patient experience. Innovative Solutions for Chiropractic Practices Fortis’ commitment to innovation is evident in its relentless pursuit of solutions tailored to the specific needs of chiropractic practices. From simplifying recurring billing to enabling seamless inventory management, Fortis’ offerings are designed to alleviate common pain points faced by chiropractors. The introduction of features like Paylink, allowing for convenient online payments, and forthcoming advancements in inventory management underscore Fortis’ dedication to empowering chiropractors with cutting-edge technology. Looking Ahead: Redefining Chiropractic Payment Technology As Fortis continues to innovate and expand its suite of services, the company remains steadfast in its mission to be a long-term partner to chiropractic practices. Jonathan’s vision for Fortis transcends mere transactional relationships; instead, he envisions a collaborative journey, where Fortis’ technology evolves in tandem with the evolving needs of chiropractors. By staying true to their core principles of reliability, innovation, and customer-centricity, Fortis aims to be the go-to solution for chiropractic payment technology for generations to come. Conclusion In a landscape where technology plays an increasingly pivotal role in healthcare delivery, Fortis stands out as a beacon of innovation and reliability in the realm of chiropractic payment solutions. With a rich legacy steeped in chiropractic care, a commitment to continuous improvement, and a deep understanding of the unique needs of chiropractors, Fortis is poised to revolutionize the way chiropractic practices manage their payments. As chiropractors navigate the complexities of running their practices, Fortis Pay remains a trusted partner, empowering them to focus on what matters most: delivering exceptional care to their patients. Genesis Nation, take note: the future of chiropractic payment technology is here, and it’s powered by Fortis.

Straight-Through Billing

Medical billing complexity and massive volumes of daily claims render manual claims processes incapable of protecting both the provider and the payer from underpayments, overpayments, and billing compliance violations. Straight-Through Billing (STB) addresses complexity and volume processing problems by automating the majority of the claim flow and focusing the billing follow-up specialists on exceptions only. An STB process flags problems routes them for follow-up and enables online correction and resubmission. The STB methodology implements billing service transparency and focuses management on strategic process improvement opportunities. Straight-Through Billing integrates the billing process into the practice management workflow, automates the vast majority of transactions, focuses manual labor on exceptions, and establishes a process for continuous improvement. Remember: Straight-Through Billing offers a comprehensive approach to improving the billing process, integrating various components, and promoting continuous improvement. Practice Management Integration First, integrated practice management and billing workflow connects patient scheduling, medical record management, and billing into a single process. Every participant in the practice management workflow receives a unified and coherent picture of the practice workload, patient and provider location, resource availability, and cash flow. However, integrated with Electronic Health Records, practice management systems are more beneficial. Electronic health records (EHR) are digital formats of a patient’s chart. They contain all the information about a patient’s health. This includes medical history, allergies, immunizations, previous treatments, medication history, past diagnoses, history of substance abuse (if any), and so forth (Shah, 2021). Transaction Automation Transaction automation streamlines and expedites the billing process by automating claim validation, payer message reconciliation, and billing workflow management: Automated claim validation eliminates errors downstream and reduces processing time because it flags errors before submitting the claim to the payer. Automated claim message reconciliation eliminates the costly search for the original claim and standardizes message communication, eliminating the need to decipher the (often cryptic) payer’s message. Automated billing workflow management drives the follow-up discipline required for the resolution of claim denial and underpayment incidents, and it establishes a high degree of process transparency for all billing process participants, resulting in full and timely payments. Automated billing increases the net collection rate due to quick claim turnaround and efficient follow-up. Respond to your denials within 5-21 business days of receiving them, using our Daily Denial Email Alerts (Qureshi, 2022). Focus on Exceptions Focusing manual labor on exceptions requires timely exception identification, routing to follow-up personnel, online error correction, and rigorous follow-up tracking. Again, process transparency enables tracking exception follow-up as implemented in ClinicMind-like systems. Another significant benefit of automated medical billing is the ability to track and analyze financial data. With this, healthcare facilities can monitor their revenue cycles, identify growth opportunities, and generate detailed financial reports (Polo, 2023). Continuous Process Improvement Finally, a process for continuous improvement requires continuous observability of every process attribute and a modification methodology for both automated claim processing and manual exception follow-up tracking. Straight-Through Billing implements billing transparency by design because billing transparency is an integral attribute of every component of the STB process. It also enables businesses to streamline their billing operations, reduce errors, enhance efficiencies, and improve the customer experience (Ward, 2023). Straight-Through Billing Architecture The Straight-Through Billing systems architecture mirrors the architecture of general Straight-Through Processing (STP) systems developed for the financial services industry. Such systems require effective workflow management, a knowledge-based validation system, connectivity to all process participants (including online data reconciliation), and tracking of problem resolution. Therefore, a typical ClinicMind-like STB system has a three-tiered architecture: Back-end processing engine designed for a high-volume transaction processing environment Middle tier, using Java Servlet technology Front end, using an HTML-JavaScript, zero-footprint client Did You Know? The STB architecture is inspired by the systems used in the financial services industry, showcasing the transferability of advanced processing concepts across different domains. An STB system (e.g., ClinicMind) based on the methodology outlined here implements rich functionality, which allows the following to be automated: Computer-aided preferential patient scheduling Integrated electronic medical records Online computer-aided coding Real-time claim validation and patient eligibility testing Electronic claim submission Payment posting, reconciliation, and verification of meeting contractual obligations Monitoring of audit risk and billing compliance Tracking of denial appeal process Quantitative STB Management Straight-Through Billing methodology allows for quantitative management since the likelihood of the entire process failing can be estimated as the product of such items for each individual workflow step. A ClinicMind-like STB system tracks the percentage of clean claims (claims paid in full, and within the allocated time frame, without any manual intervention) and focuses the management on those process aspects that yield the greatest potential improvement. Thus, STB methodology focuses on exceptions at both the tactical and strategic management levels and can help to improve cash flow and reduce outstanding invoices by providing real-time visibility into billing and payment status (Mielnicki, 2022). Modern Insights and Research In the ever-evolving field of medical billing, staying ahead of the curve is crucial for achieving financial excellence in the healthcare industry. Let’s embark on an exhilarating journey into the future of medical billing, where the convergence of electronic health records (EHRs), artificial intelligence (AI), real-time analytics, and collaborative efforts reshapes the revenue cycle landscape. Brace yourself for a transformative exploration that revolutionizes processes, enhances data accuracy, maximizes financial outcomes, and ushers in an era of unparalleled efficiency and effectiveness in the dynamic realm of medical billing. 1- Role of Blockchain Technology in Billing Systems The seamless integration of electronic health records (EHRs) and billing systems is revolutionizing the field of medical billing. Gone are the days of fragmented medical records scattered across various healthcare organizations. With blockchain at the helm, a distributed EHR ecosystem emerges, ensuring a smooth flow of information between providers. By eliminating manual data entry and ensuring accurate documentation, this innovative technology guarantees accurate and secure documentation, eliminating errors and speeding up reimbursement processes (Cerchione et al., 2022). But that’s not all. Blockchain brings an unparalleled level of data integrity and security, employing cryptographic techniques to safeguard patient information from prying eyes.

Decoding the Complexities of Chiropractic Billing and Coding

With over 16 years of chiropractic practice, Dr. Marty Kotlar from Target Coding brings a unique blend of real-life experience and coding expertise, holding certifications as a Professional Compliance Officer and Billing and Coding Specialist. In this conversation with Genesis, Dr. Kotlar shares his insights and sheds light on the top three mistakes chiropractors commonly make in billing, coding, and compliance. Insurance Practices Dr. Kotlar kicks off our discussion by emphasizing the importance of meticulous tracking in insurance-based practices. He introduces the concept of an insurance tracking spreadsheet, stressing the need to record every payment accurately to avoid potential discrepancies. He also touches on common issues such as copay discrepancies and claim processing errors, urging practitioners to ensure they receive rightful reimbursement. Moving on, Dr. Kotlar delves into the world of codes. He discusses the nuances of time-based codes and non-time-based codes, providing valuable insights into maximizing reimbursement through proper coding. Exploring the intricacies of time-based codes like therapeutic exercises (97110), he unveils the critical factors providers should consider for accurate coding. In the final segment of insurance practices, Dr. Kotlar addresses the challenge of maximizing reimbursement. He shares pearls of wisdom, including the often-overlooked activities of daily living (ADLs) code (97535) and the significance of extremity adjustments. By unraveling the complexity of re-exams and other reimbursable services, Dr. Kotlar provides actionable strategies for practitioners aiming to optimize their revenue in insurance-based practices. Personal Injury (PII) Shifting the focus to personal injury (PII) practices, Dr. Kotlar enlightens us on the crucial role SOAP notes play in building strong cases for attorneys. He emphasizes the importance of documenting “duties under duress” and “loss of enjoyment of life,” elements that can significantly impact the patient’s life post-accident. Dr. Kotlar discusses the potential pitfalls associated with overprescribing in PII cases, cautioning against unnecessary procedures or devices. He sheds light on compliance challenges related to devices like back braces, TENS machines, and home traction units. Additionally, he underscores the necessity of thorough follow-ups to prove the clinical necessity of prescribed items. In this segment, Dr. Kotlar unveils the complexities of fee schedules, dual fee schedules, and the state-specific regulations chiropractors must navigate in the PII landscape. By addressing these challenges, he equips practitioners with the knowledge needed to build strong PII practices while ensuring compliance with legal and ethical standards. Cash Practices Dr. Kotlar concludes our conversation by exploring the nuances of cash practices. He starts by cautioning against misleading advertising practices, emphasizing the need for compliance even in cash-based settings. The discussion then pivots to the intricacies of prepaid plans, highlighting the potential risks associated with mishandling prepaid funds and the necessity of putting money in escrow. The conversation takes an insightful turn as Dr. Kotlar delves into the complex realm of discounts in cash practices. He demystifies the restrictions and allowances surrounding discounts, providing practitioners with a clearer understanding of how to navigate this aspect successfully. The final focus of our discussion centers on distinguishing between medically necessary care and maintenance or wellness care in cash practices. Dr. Kotlar outlines the importance of accurately coding services based on the nature of the patient’s visit, offering practical guidance for maintaining compliance and avoiding pitfalls. Conclusion: As our enlightening conversation with Dr. Marty Kotlar concludes, chiropractors and practitioners in allied fields gain a wealth of knowledge to enhance their billing and coding practices. Dr. Kotlar’s expertise and insights serve as a compass, guiding practitioners through the intricate landscape of compliance, reimbursement optimization, and ethical considerations. In the ever-evolving field of chiropractic care, staying informed and proactive is key, and Dr. Kotlar’s wisdom provides a valuable roadmap for success. Stay tuned for Part 2 of this conversation to be released next week! Experience the entire episode by viewing it through: https://bit.ly/3U5sACL

Revolutionizing Documentation and Billing: FlexNote

We are thrilled to dive into the latest technological marvel from Genesis Chiropractic Software – the FlexNote. Our Chief Technology Officer, Erez Lirov, takes the stage to unveil a groundbreaking approach to documentation and billing. In this dynamic conversation, the focus is on addressing the common concerns of chiropractors, especially regarding the speed and efficiency of documentation. Dr. Brian Paris and Erez explore the challenges faced by practitioners in high-volume chiropractic and integrated practices involving multiple disciplines. The FlexNote introduces a seamless integration of high-speed chiropractic interfaces, known from previous generations, with a customizable daily note system. The goal is to provide chiropractors and allied healthcare professionals, including nurse practitioners, physical therapists, and medical doctors, with a unified platform that caters to diverse workflows. The key features of the FlexNote include a comprehensive patient chart view accessible to the entire care team, synchronized information such as medications and tasks, and a mobile-friendly patient portal. Erez showcases the speed and convenience of creating notes by incorporating vital signs, macros, and dictation capabilities. What sets the FlexNote apart is its adaptability for various medical disciplines, allowing practitioners to create configurable and customizable notes tailored to their specific needs. The system even supports the use of macros for swift and efficient note creation. With a live demonstration, Erez illustrates the efficiency of the FlexNote, emphasizing its ability to streamline workflows for practitioners dealing with multidisciplinary cases. The system’s user interface and experience have been meticulously designed to enhance the speed and ease of creating comprehensive notes. Exciting upcoming features include integrated x-rays and images, along with a navigation bar for quick access to different sections within lengthy notes. The FlexNote is already in use by select offices, receiving positive feedback for its transformative impact on documentation and billing processes. For those eager to explore the FlexNote and enhance their practice’s efficiency, Genesis Chiropractic Software encourages early adoption. The FlexNote represents a significant leap forward in chiropractic software, providing a versatile solution for practitioners with diverse needs and preferences. Stay tuned for more tech updates from Genesis Chiropractic Software as we continue to innovate and empower chiropractors on their journey to creating dream practices. If you have questions or want to explore FlexNote, reach out to us via the chat now feature. Your practice’s technological evolution begins here! To watch the full episode, you may it view it via: https://bit.ly/3NPFbWG

AI in Medical Billing

AI has revolutionized many different industries, and healthcare is no exception. In recent years, medical billing has benefited greatly from using Artificial Intelligence. Where are the major pain points in healthcare today? 1-Patients: A major challenge today is long wait times. In 2022, the average wait time for a physician appointment in the 15 largest U.S. metro markets is 26 days [1]. The longer someone has to wait, the higher the risk of complications or possibly more serious health issues arising. Some possible solutions to address this problem include use of telemedicine involves providing medical consultations and services remotely using technology such as video conferencing. increasing the number of healthcare professionals in practice, streamlining administrative processes and improving patient communication and education to help prevent avoidable illnesses and hospital visits. 2-Physicians: Physician burnout is affecting a high percentage of physicians. 62.8% of physicians experienced at least one symptom of burnout in 2021 [2]. Reasons for burnout include outdated technology and inefficient workflows, which contribute to increased work stress and frustration even for skilled and experienced professionals. Additionally, a shortage of skilled workers puts extra pressure on those in the workforce, leading to burnout and poor job satisfaction. One potential way to address these challenges is to invest in updating technology and improving workflows, which can streamline processes and reduce workload. Additionally, increasing access to training and education for both current and future workers could help alleviate the skill shortage issue. It’s essential to take proactive steps to address these issues to ensure that our healthcare workforce can continue to provide top-quality care to patients without experiencing burnout. 3-Payers: Payers recognize the importance of delivering better experiences to their customers. To meet these expectations, payers are focusing on several critical areas: A-Improving ease of use Improving ease of use can be achieved through various initiatives, such as clear communication to help customers understand their network, status updates on claims, and easy-to-use portals and tools. B-Ensuring the availability of services on-demand. Having around-the-clock access to support and information is essential to ensuring customers can get the help they need when they need it. To support these initiatives, payers need to leverage data-driven insights to create value for their customers. This can be achieved through technologies such as artificial intelligence and machine learning, which can help to identify trends and patterns in customer behavior and preferences, enabling payers to provide targeted and personalized support proactively. Overall, payers must continue to innovate and adapt to meet the evolving needs and expectations of their customers, and taking a data-driven approach to improve ease of use and availability on demand could be a critical step forward. C-Reducing hospital readmission rates Payers are leveraging machine learning to gain actionable insights from healthcare data sets. By analyzing claims data, payers can identify trends in patient outcomes and determine the most effective treatments for specific patient populations. They can also predict which patients are at a higher risk of complications or readmissions, e.g., inflammation and blood clotting occurs most following surgery, and provide this information to providers to help them take preventative measures. This kind of data-driven approach is valuable because it enables healthcare providers to deliver more personalized care to patients, leading to improved patient outcomes and reduced costs. By sharing these insights, payers can demonstrate the value of their contributions to patient care while simultaneously empowering providers to make better decisions and improve healthcare delivery. Improved Medical Coding Accuracy One way AI has been used in medical billing is through automated billing and coding. The technology can analyze electronic health records and notes made by healthcare providers and use that information to generate codes that accurately bill for specific services. This reduces the risk of errors, which can result in denied claims and lost revenue. Improved Insurance Cash Flow Prediction and Denial Management AI is also used for claims prediction. By analyzing past claims data, AI identifies patterns and predicts which claims will likely be denied. This allows billing teams to proactively address issues and avoid denials, which saves time and money. Also, when denials are increasing due to a lack of medical necessity, lacking documentation, or coding mistakes, AI can analyze the denials to find the cause and then create tasks within the EHR to correct the likely causes for denials. Improved Medical Billing Workflow To automate the claims follow-up process, AI analyzes claims data and identifies the claims that are most likely to require follow-up. AI automatically generates follow-up tasks for billing teams. This reduces the administrative burden on billing teams and ensures that claims are followed up on in a timely manner. The deep learning of users’ interaction with EHR and billing software allows the learning of users’ habits, needs anticipation, and the display of the right data at the right time. Automatically retrieving and displaying all of the required data and just at the right time drastically reduces the amount of labor spent on manual billing tasks and allows staff to make better decisions about the next steps for denial resolution. Improved and Expedited Pre-Authorizations The current pre-authorization process can be a real headache for patients and healthcare providers. A streamlined, automated system that can quickly analyze a patient’s health data and determine the medical necessity of a procedure would be a game changer. Imagine how much time, stress, and resources could be saved if medical billers no longer had to worry about pre-authorization denials or chasing down authorization numbers. It’s exciting to think about how technology can continue to improve and simplify healthcare processes like this. Improved patient customer service With the rise of technology, we’re seeing a lot of improvements in healthcare that can benefit patients and providers alike. Using bots for patient interactions like appointment scheduling and payment collection is one way to streamline processes and reduce frustration for patients and billing staff. By standardizing these tasks, there’s less room for error and confusion, leading to smoother, more efficient